Page 177 - AR DPBM-2016--SMALL

P. 177

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

Neraca

Balance Sheet

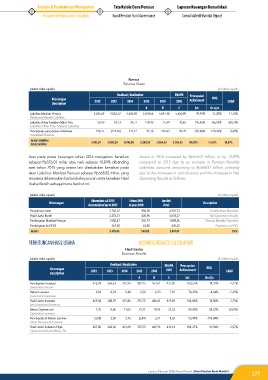

(dalam miliar rupiah) (in billion rupiah)

Realisasi | Realization RKAPB Pencapaian

Keterangan 2012 2013 2014 2015 2016 2016 Achievment ROG CAGR

Description

A B C b/c (b-a)/a

Liabilitas Manfaat Pensiun 3.625,69 4.062,52 4.586,92 5.078,66 5.647,48 5.650,90 99,94% 11,20% 11,72%

Retirement Benefit Liabilities

Liabilitas Diluar Keajiban Manf. Pen. 59,43 10,73 34,77 118,43 15,49 10,65 145,46% -86,92% -28,54%

Liabilities Other Than Actuarial Liabilities

Pendapatan yang belum direalisasi 196,17 (224,96) 125,12 91,50 201,63 99,29 203,06% 120,35% 0,69%

Unrealized Revenue

Jumlah Liabilitas

Total Liabilities 3.881,30 3.848,29 4.746,80 5.288,59 5.864,59 5.760,85 101,80% 10,89% 10,87%

Aset pada posisi keuangan tahun 2016 mengalami kenaikan Assets in 2016 increased by Rp576.01 billion or by 10.89%

sebesar Rp576,01 miliar atau naik sebesar 10,89% dibanding compared to 2015 due to an increase in Pension Benefits

aset tahun 2015 yang antara lain disebabkan kenaikan pada Liabilities accounts amounting to Rp568.82 billion, primarily

akun Liabilitas Manfaat Pensiun sebesar Rp568,82 miliar, yang due to the increases in contributions and the increases in Net

terutama dikarenakan bertambahnya iuran serta kenaikan Hasil Operating Results as follows:

Usaha Bersih sebagaimana berikut ini:

(dalam miliar rupiah) (in billion rupiah)

Akumulasi s.d 2015 Tahun 2016 Jumlah

Keterangan Description

Accumulated up to 2015 In year 2016 Total

Penerimaan Iuran 3.743,67 558,05 4.301,72 Contributions Received

Hasil Usaha Bersih 3.253,31 420,96 3.674,27 Net Operations Results

Pembayaran Manfaat Pensiun 1.550,47 347,79 1.898,26 Pension Benefits Payments

Pembayaran ke DPLK 367,85 62,40 430,25 Payments to DPLK

Jumlah 5.078,65 568,82 5.647,47 Total

PERHITUNGAN HASIL USAHA BUSINESS RESULTS CALCULATION

hasil Usaha

Business Results

(dalam miliar rupiah) (in billion rupiah)

Realisasi | Realization RKAPB Pencapaian

Keterangan 2012 2013 2014 2015 2016 2016 Achievement ROG CAGR

Description

A B C b/c (b-a)/a

Pendapatan Investasi 476,28 356,63 431,34 382,25 452,61 437,01 103,57% 18,41% -1,27%

Investment income

Beban Investasi 6,83 8,24 9,48 6,50 6,20 7,92 78,32% -4,64% -2,39%

Investment Expenses

Hasil Usaha Investasi 469,44 348,39 421,86 375,75 446,41 429,09 104,04% 18,80% -1,25%

Net Investment Revenue

Beban Operasional 7,75 8,86 11,02 13,71 18,96 21,23 89,29% 38,27% 25,09%

Operating Expenses

Pendapatan & Beban Lain-lain (3,85) 2,50 2,76 (2,49) 2,31 4,28 53,98% -193,04% -

Other Revenue & Expense

Hasil Usaha Sebelum Pajak 457,85 342,02 413,60 359,55 429,76 412,14 104,27% 19,53% -1,57%

Operations Results Before Tax

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

177