Page 179 - AR DPBM-2016--SMALL

P. 179

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

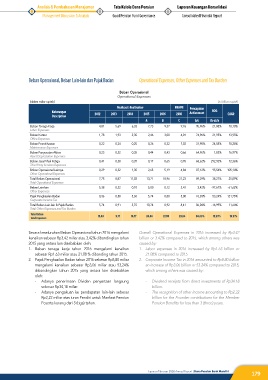

Beban Operasional, Beban Lain-lain dan Pajak Badan Operational Expenses, Other Expenses and Tax Burden

Beban Operasional

Operational Expenses

(dalam miliar rupiah) (in billion rupiah)

Realisasi | Realization RKAPB Pencapaian

Keterangan 2012 2013 2014 2015 2016 2016 Achievment ROG CAGR

Description

A B C b/c (b-a)/a

Beban Tenaga Kerja 4,81 5,69 6,33 7,73 9,37 9,76 95,96% 21,08% 18,10%

Labor Expenses

Beban Kantor 1,78 1,93 2,35 2,46 3,00 4,01 74,96% 21,95% 13,95%

Office Expenses

Beban Pemeliharaan 0,22 0,24 0,25 0,26 0,32 1,02 31,90% 24,58% 10,28%

Maintenance Expenses

Beban Penyusutan Aktiva 0,23 0,32 0,35 0,44 0,43 0,66 64,96% -1,83% 16,97%

Asset Depreciation Expenses

Beban Jasa Pihak Ketiga 0,41 0,38 0,39 0,17 0,65 0,95 68,62% 292,92% 12,36%

Third Party Services Expenses

Beban Operasional Lainnya 0,29 0,32 1,35 2,65 5,19 4,84 07,12% 95,54% 105,14%

Other Operational Expenses

Total Beban Operasional 7,75 8,87 11,02 13,71 18,96 21,23 89,29% 38,27% 25,09%

Total Operational Expenses

Beban Lain-lain 5,38 0,32 0,10 5,00 0,12 3,41 3,42% -97,67% -61,62%

Other Expenses

Pajak Penghasilan Badan 0,36 0,58 5,65 5,74 8,80 5,00 76,03% 53,24% 121,75%

Corporate Income Tax

Total Beban Lain-lain & Pajak Badan 5,74 0,91 5,75 10,74 8,92 8,41 06,04% -16,99% 11,64%

Total Other Expenses and Tax Burden

Total Beban 13,49 9,77 16,77 24,46 27,88 29,64 94,05% 13,99% 19,91%

Total Expenses

Secara keseluruhan Beban Operasional tahun 2016 mengalami Overall Operational Expenses in 2016 increased by Rp3.42

kenaikan sebesar Rp3,42 miliar atau 3,42% dibandingkan tahun billion or 3.42% compared to 2015, which among others was

2015 yang antara lain disebabkan oleh: caused by:

1. Beban tenaga kerja tahun 2016 mengalami kenaikan 1. Labor expenses in 2016 increased by Rp1.63 billion or

sebesar Rp1,63 miliar atau 21,08 % dibanding tahun 2015. 21.08% compared to 2015.

2. Pajak Penghasilan Badan tahun 2016 sebesar Rp8,80 miliar 2. Corporate Income Tax in 2016 amounted to Rp8.80 billion

mengalami kenaikan sebesar Rp3,06 miliar atau 53,24% an increase of Rp3.06 billion or 53.24% compared to 2015,

dibandingkan tahun 2015 yang antara lain disebabkan which among others was caused by:

oleh:

- Adanya penerimaan Dividen penyertaan langsung - Dividend receipts from direct investments of Rp34.18

sebesar Rp34,18 miliar. billion.

- Adanya pengakuan ke pendapatan lain-lain sebesar - The recognition of other income amounting to Rp2.22

Rp2,22 miliar atas iuran Pendiri untuk Manfaat Pensiun billion for the Founder contributions for the Member

Peserta kurang dari 3 (tiga) tahun. Pension Benefits for less than 3 (three) years.

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

179