Page 178 - AR DPBM-2016--SMALL

P. 178

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

hasil Usaha

Business Results

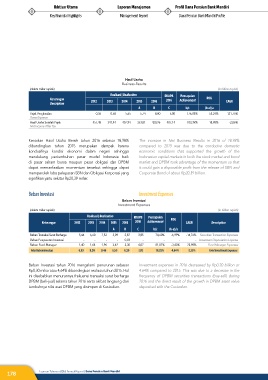

(dalam miliar rupiah) (in billion rupiah)

Realisasi | Realization RKAPB Pencapaian

Keterangan 2012 2013 2014 2015 2016 2016 Achievement ROG CAGR

Description

A B C b/c (b-a)/a

Pajak Penghasilan 0,36 0,58 5,65 5,74 8,80 5,00 176,03% 53,24% 121,75%

Taxes Expense

Hasil Usaha Setelah Pajak 457,48 341,44 407,94 353,81 420,96 407,14 103,39% 18,98% -2,06%

Net Income After Tax

Kenaikan Hasil Usaha Bersih tahun 2016 sebesar 18,98% The increase in Net Business Results in 2016 of 18.98%

dibandingkan tahun 2015 merupakan dampak karena compared to 2015 was due to the conducive domestic

kondusifnya kondisi ekonomi dalam negeri sehingga economic conditions that supported the growth of the

mendukung pertumbuhan pasar modal Indonesia baik Indonesian capital markets in both the stock market and bond

di pasar saham bursa maupun pasar obligasi dan DPBM market and DPBM took advantage of the momentum so that

dapat memanfaatkan momentum tersebut sehingga dapat it could gain a disposable profit from the release of SBN and

memperoleh laba pelepasan SBN dan Obligasi Korporasi yang Corporate Bond of about Rp20.39 billion.

signifikan yaitu sekitar Rp20,39 miliar.

Beban Investasi Investment Expenses

Beban Investasi

Investment Expenses

(dalam miliar rupiah) (in billion rupiah)

Realisasi | Realization RKAPB Pencapaian

Keterangan 2012 2013 2014 2015 2016 2016 Achievement ROG CAGR Description

A B C b/c (b-a)/a

Beban Transaksi Surat Berharga 5,44 6,60 7,52 3,09 2,87 3,85 74,60% -6,99% -14,76% Securities Transaction Expenses

Beban Penyusutan Investasi - - - - 0,03 - - - - Investment Depreciation Expense

Beban Fund Manager 1,40 1,64 1,96 3,42 3,30 4,07 81,07% -3,43% 23,98% Fund Manager Expenses

Total Beban Investasi 6,83 8,24 9,48 6,50 6,20 7,92 78,32% -4,64% -2,39% Total Investment Expenses

Beban Investasi tahun 2016 mengalami penurunan sebesar Investment expenses in 2016 decreased by Rp0.30 billion or

Rp0,30 miliar atau 4,64% dibandingkan realisasi tahun 2015. Hal 4.64% compared to 2015. This was due to a decrease in the

ini disebabkan menurunnya frekuensi transaksi surat berharga frequency of DPBM securities transactions (buy-sell) during

DPBM (beli-jual) selama tahun 2016 serta akibat langsung dari 2016 and the direct result of the growth in DPBM asset value

tumbuhnya nilai aset DPBM yang disimpan di Kustodian. deposited with the Custodian.

178 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri