Page 174 - AR DPBM-2016--SMALL

P. 174

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

Analisis atas kesesuaian Investasi dengan Batasan Investasi The analysis above regarding conformity between Investment

per jenis investasi berdasarkan ketentuan Peraturan Otoritas Limit with Investment Type is based on the Otoritas Jasa

Jasa Keuangan (POJK) No.03/POJK.05/2015 tanggal 31 Maret Keuangan (Regulation POJK) No. 03/POJK.05/2015 dated

2015 tentang Investasi Dana Pensiun menunjukan bahwa March 31, 2015 on Pension Fund Investment and shows that

pelaksanaan investasi DPBM selama periode 1 Januari 2016 the DPBM investments during the period January 1, 2016 to

hingga 31 Desember 2016 telah sesuai dengan batasan December 31, 2016 were in accordance with the investment

investasi per jenis investasi yang telah diatur dalam Peraturan limits per investment type as regulated in the OJK Regulations,

OJK tersebut, dan Arahan Investasi yang ditetapkan dalam and the Investment Directive from the PT Bank Mandiri

keputusan Direksi PT Bank Mandiri (Persero) Tbk tanggal 31 (Persero) Tbk Board of Directors dated May 31, 2016.

Mei 2016.

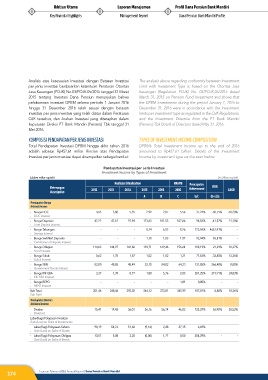

KOMPOSISI PENDAPATAN PER JENIS INVESTASI TyPES OF INVESTMENT INCOME COMPOSITION

Total Pendapatan Investasi DPBM hingga akhir tahun 2016 DPBM’s Total Investment Income up to the end of 2016

adalah sebesar Rp452,61 miliar. Rincian atas Pendapatan amounted to Rp452.61 billion. Details of the Investment

Investasi per jenis investasi dapat disampaikan sebagai berikut: Income by investment type can be seen below:

Pendapatan Investasi per Jenis Investasi

Investment Income by Types of Investment

(dalam miliar rupiah) (in billion rupiah)

Realisasi | Realization RKAPB Pencapaian

Keterangan 2012 2013 2014 2015 2016 2016 Achievement ROG CAGR

Description

A B C b/c (b-a)/a

Pendapatan Bunga

Interest income

- Bunga DOC 4,63 3,80 5,35 2,99 2,07 5,56 37,24% -30,75% -18,20%

- DOC Interest

- Bunga Deposito 47,22 47,67 97,94 173,63 101,53 107,06 94,83% -41,52% 21,10%

- Time Deposit Interest

- Bunga Tabungan - - - 0,14 6,52 5,26 123,96% 4661,91% -

- Savings Interest

- Bunga Sertifikat Deposito - - - 1,18 1,83 1,97 92,94% 55,51% -

- Certificates of Deposit Interest

- Bunga Obligasi 114,63 144,97 141,60 139,71 169,46 156,64 108,19% 21,29% 10,27%

- Bond Interest

- Bunga Sukuk 0,62 1,78 1,87 1,52 1,02 1,31 77,83% -32,85% 13,26%

- Sukuk Interest

- Bunga SBN 82,00 48,85 45,49 23,15 84,82 64,33 131,85% 266,40% 0,85%

- Government Bonds Interest

- Bunga KIK EBA 2,37 1,39 0,77 1,80 5,76 2,05 281,25% 219,91% 24,83%

- KIK EBA Interest

- Bunga REPO - - - - - 1,81 0,00% - -

- REPO Interest

Sub Total 251,46 248,46 293,02 344,12 373,01 345,99 107,81% 8,40% 10,36%

Sub Total

Pendapatan Dividen

Dividend Income

- Dividen 15,41 19,43 36,01 36,16 56,74 46,02 123,29% 56,90% 38,53%

- Dividend

Laba (Rugi) Pelepasan Investasi

Gain (Loss) on Sales of Investments

- Laba (Rugi) Pelepasan Saham 90,19 54,76 51,60 (9,14) 2,48 37,15 6,69% - -

- Gain (Loss) on Sales of Stocks

- Laba (Rugi) Pelepasan Obligasi 13,57 5,08 2,20 (0,00) 1,77 0,50 354,29% - -

- Gain (Loss) on Sales of Bonds

174 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri