Page 172 - AR DPBM-2016--SMALL

P. 172

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

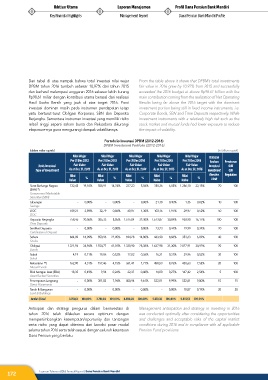

Dari tabel di atas nampak bahwa total investasi nilai wajar From the table above it shows that DPBM’s total investments

DPBM tahun 2016 tumbuh sebesar 10,97% dari tahun 2015 fair value in 2016 grew by 10.97% from 2015 and successfully

dan berhasil melampaui anggaran 2016 sebesar lebih kurang exceeded the 2016 budget at above Rp98.61 billion with the

Rp98,61 miliar dengan kontribusi utama berasal dari realisasi main contribution coming from the realization of Net Operating

Hasil Usaha Bersih yang jauh di atas target 2016. Porsi Results being far above the 2016 target with the dominant

investasi dominan masih pada instrumen pendapatan tetap investment portion being still in fixed income instruments, i.e.

yaitu berturut-turut Obligasi Korporasi, SBN dan Deposito Corporate Bonds, SBN and Time Deposits respectively. While

Berjangka. Sementara instrumen investasi yang memiliki risiko investment instruments with a relatively high risk such as the

relatif tinggi seperti saham bursa dan Reksadana dikurangi stock market and mutual funds had lower exposure to reduce

eksposure-nya guna mengurangi dampak volatilitasnya. the impact of volatility.

Portofolio Investasi DPBM (2012-2016)

DPBM Investment Portfolio (2012-2016)

(dalam miliar rupiah) (in billion rupiah)

Nilai Wajar Nilai Wajar Nilai Wajar Nilai Wajar Nilai Wajar Batasan

Per 31 Des 2012 Per 31 Des 2013 Per 31 Des 2014 Per 31 Des 2015 Per 31 Des 2016 Arahan Peraturan

Jenis Investasi Fair Value Fair Value Fair Value Fair Value Fair Value Investasi OJK

Type of Investment As at Dec 31, 2012 As at Dec 31, 2013 As at Dec 31, 2014 As at Dec 31, 2015 As at Dec 31, 2016 Investment OJK

Nilai Nilai Nilai Nilai Nilai Directive Regulation

Value % Value % Value % Value % Value % Limit

Surat Berharga Negara 722,45 19,10% 558,91 14,74% 237,23 5,06% 358,36 6,85% 1.286,10 22,15% 70 100

(SBN) *)

Government Marketable

Securities (SBN)

Tabungan - 0,00% - 0,00% - 0,00% 21,18 0,40% 1,36 0,02% 10 100

Savings

DOC 109,21 2,89% 32,79 0,86% 60,97 1,30% 103,16 1,97% 29,97 0,52% 50 100

DOC

Deposito Berjangka 758,46 20,06% 305,33 8,05% 1.515,04 32,30% 1.613,87 30,84% 938,90 16,17% 100 100

Time Deposits

Sertfikat Deposito - 0,00% - 0,00% - 0,00% 23,23 0,44% 19,99 0,34% 20 100

Certificates of Deposit

Saham 684,09 18,09% 850,96 22,45% 694,28 14,80% 463,90 8,86% 353,63 6,09% 40 100

Stocks

Obligasi 1.321,96 34,96% 1.554,77 41,01% 1.330,90 28,38% 1.637,98 31,30% 2.027,91 34,92% 20 100

Bonds

Sukuk 4,19 0,11% 19,86 0,52% 17,02 0,36% 16,31 0,31% 29,96 0,52% 30 100

Sukuk

Reksadana **) 162,90 4,31% 157,46 4,15% 361,47 7,71% 458,53 8,76% 438,63 7,55% 20 100

Mutual Funds

Efek beragun Aset (EBA) 18,35 0,49% 9,94 0,26% 22,37 0,48% 14,00 0,27% 147,42 2,54% 5 100

Asset Backed Securities

Penempatan Langsung - 0,00% 301,03 7,94% 450,94 9,61% 522,81 9,99% 522,81 9,00% 15 15

Direct Placements

Tanah & Bangunan - 0,00% - 0,00% - 0,00% - 0,00% 10,87 0,19% 20 20

Land & Buildings

Jumlah | Total 3.781,61 100,00% 3.791,04 100,00% 4.690,22 100,00% 5.233,32 100,00% 5.807,53 100,00%

Antisipasi dan strategi pengurus dalam berinvestasi di Management anticipation and strategy in investing in 2016

tahun 2016 telah dilakukan secara optimum dengan was conducted optimally after considering the opportunities

mempertimbangkan kesempatan/oportunity dan tantangan and challenges and acceptable risks of the capital market

serta risiko yang dapat diterima dari kondisi pasar modal conditions during 2016 and in compliance with all applicable

selama tahun 2016 serta telah sesuai dengan seluruh ketentuan Pension Fund provisions.

Dana Pensiun yang berlaku.

172 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri