Page 175 - AR DPBM-2016--SMALL

P. 175

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

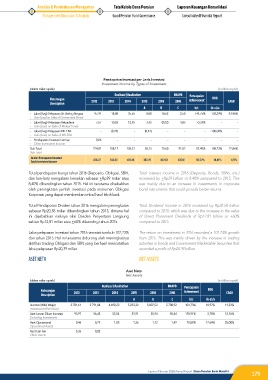

Pendapatan Investasi per Jenis Investasi

Investment Income by Types of Investment

(dalam miliar rupiah) (in billion rupiah)

Realisasi | Realization RKAPB Pencapaian

Keterangan 2012 2013 2014 2015 2016 2016 Achievement ROG CAGR

Description

A B C b/c (b-a)/a

- Laba (Rugi) Pelepasan Srt Berhrg Negara 97,91 18,88 35,55 8,08 18,62 2,50 744,75% 130,29% -33,96%

- Gain (Loss) on Sales of Government Bonds

- Laba (Rugi) Pelepasan Reksadana 7,67 10,26 12,95 3,45 (0,02) 4,85 -0,33% - -

- Gain (Loss) on Sales of Mutual Funds

- Laba (Rugi) Pelepasan KIK EBA - (0,24) - (0,44) - - - -100,00% -

- Gain (Loss) on Sales of KIK EBA

- Pendapatan Investasi Lainnya 0,06 - - - - - - - -

- Other Investment Income

Sub Total 224,81 108,17 138,31 38,13 79,60 91,02 87,45% 108,73% 22,86%

Sub Total

Jumlah Pendapatan Investasi 476,27 356,63 431,34 382,25 452,61 437,01 103,57% 18,41% 1,27%

Total Investment Income

Total pendapatan bunga tahun 2016 (Deposito, Obligasi, SBN, Total interest income in 2016 (Deposits, Bonds, SBNs, etc.)

dan lain-lain) mengalami kenaikan sebesar +Rp29 miliar atau increased by +Rp29 billion or 8.40% compared to 2015. This

8,40% dibandingkan tahun 2015. Hal ini terutama disebabkan was mainly due to an increase in investments in corporate

oleh peningkatan jumlah investasi pada instrumen Obligasi bond instruments that could provide better returns.

Korporasi yang dapat memberikan imbal hasil lebih baik.

Total Pendapatan Dividen tahun 2016 mengalami peningkatan Total Dividend Income in 2016 increased by Rp20.58 billion

sebesar Rp20,58 miliar dibandingkan tahun 2015, dimana hal compared to 2015, which was due to the increase in the value

ini disebabkan naiknya nilai Dividen Penyertaan Langsung of Direct Placement Dividends of Rp12.81 billion or +60%

sekitar Rp12,81 miliar atau +60% dibanding tahun 2015. compared to 2015.

Laba pelepasan investasi tahun 2016 tercatat tumbuh 107,73% The return on investment in 2016 recorded a 107.73% growth

dari tahun 2015. Hal ini terutama didorong oleh meningkatnya from 2015. This was mainly driven by the increase in trading

aktifitas trading Obligasi dan SBN yang berhasil mencatatkan activities in bonds and Government Marketable Securities that

laba pelepasan Rp20,39 miliar. recorded a profit of Rp20.39 billion.

ASET NETO NET ASSETS

Aset Neto

Net Assets

(dalam miliar rupiah) (in billion rupiah)

Realisasi | Realization RKAPB Pencapaian

Keterangan 2012 2013 2014 2015 2016 2016 Achievement ROG CAGR

Description

A B C b/c (b-a)/a

Investasi (Nilai Wajar) 3.781,61 3.791,04 4.690,22 5.233,32 5.807,53 5.708,92 101,73% 10,97% 11,32%

Investments (Fair Value)

Aset Lancar Diluar Investasi 93,97 56,45 55,54 53,91 55,94 50,44 110,91% 3,78% -12,16%

Excluding Investments

Aset Operasional 0,46 0,79 1,05 1,36 1,12 1,49 75,05% -17,64% 25,08%

Operational Assets

Aset Lain-lain 5,26 0,02 - - - - - - -

Other Assets

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

175