Page 173 - AR DPBM-2016--SMALL

P. 173

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

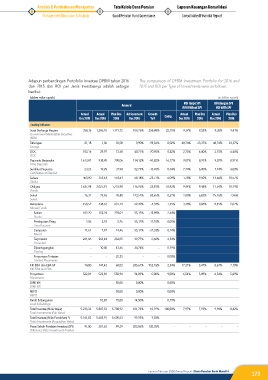

Adapun perbandingan Portofolio Investasi DPBM tahun 2016 The comparison of DPBM Investment Portfolio for 2016 and

dan 2015 dan ROI per Jenis Investasinya adalah sebagai 2015 and ROI per Type of Investments were as follows:

berikut:

(dalam miliar rupiah) (in billion rupiah)

ROI Tanpa SPI ROI dengan SPI

Amount

ROI Without SPI ROI With SPI

Actual Actual Plan Des Achievement Growth Actual Plan Des Actual Plan Des

Des 2015 Des 2016 2016 Des 2016 YoY Comp. Des 2016 2016 Des 2016 2016

Leading Indicators

Surat Berharga Negara 358,36 1.286,10 1.171,72 109,76% 258,88% 22,15% 9,39% 9,55% 9,30% 9,41%

Government Marketable Securities

(SBN)

Tabungan 21,18 1,36 35,00 3,90% -93,56% 0,02% 48,74% 23,37% 48,74% 23,37%

Savings

DOC 103,16 29,97 73,60 40,71% -70,95% 0,52% 2,75% 6,40% 2,75% 6,40%

DOC

Deposito Berjangka 1.613,87 938,90 700,06 134,12% -41,82% 16,17% 9,07% 8,91% 9,07% 8,91%

Time Deposits

Sertifikat Deposito 23,23 19,99 37,90 52,73% -13,96% 0,34% 7,74% 6,00% 7,74% 6,00%

Certificates of Deposit

Saham 463,90 353,63 518,63 68,18% -23,77% 6,09% 1,78% 9,50% 14,66% 10,57%

Stocks

Obligasi 1.637,98 2.027,91 1.733,98 116,95% 23,81% 34,92% 9,44% 9,48% 11,54% 10,14%

Bonds

Sukuk 16,31 29,96 20,88 143,51% 83,65% 0,52% 2,80% 6,83% 25,26% 7,96%

Sukuk

Reksadana 458,52 438,63 631,19 69,49% -4,34% 7,55% 3,48% 0,84% 8,81% 2,07%

Mutual Funds

Saham 182,20 153,24 278,01 55,12% -15,89% 2,64%

Stocks

Pendapatan Tetap 2,86 3,18 5,76 55,12% 11,10% 0,05%

Fixed Income

Campuran 11,61 7,97 14,46 55,12% -31,33% 0,14%

Mixed

Terproteksi 261,86 263,44 264,05 99,77% 0,60% 4,54%

Protected

Diperdagangkan - 10,80 43,66 24,74% - 0,19%

Trading

Penyertaan Terbatas - - 25,25 - - 0,00%

Limited Placements

KIK EBA dan EBA SP 14,00 147,42 60,02 245,61% 952,76% 2,54% 17,31% 5,47% 8,67% 7,10%

KIK EBA and EBA

Penyertaan 522,81 522,81 550,94 94,89% 0,00% 9,00% 6,54% 5,89% 6,54% 5,89%

Placements

DIRE KIK - - 50,00 0,00% - 0,00% - - - -

DIRE KIK

REPO - - 50,00 0,00% - 0,00% - - - -

REPO

Tanah & Bangunan - 10,87 75,00 14,50% - 0,19% - - -

Land & Buildings

Total lnvestasi (Ni/ai Wajar) 5.233,32 5.807,53 5.708,92 101,73% 10,97% 100,00% 7,97% 7,93% 9,94% 8,42%

Total Investments (Fair Value)

Total lnvestasi (Nilai Perolehan) *) 5.141,82 5.605,91 5.609,63 99,93% 9,03% - - - - -

Total Investments (Acquisition Value)

Posisi Selisih Penilaian lnvestasi (SPI) 91,50 201,63 99,29 203,06% 120,35% - - - - -

Difference Rate Investments Position

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

173