Page 288 - AR DPBM-2016--SMALL

P. 288

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

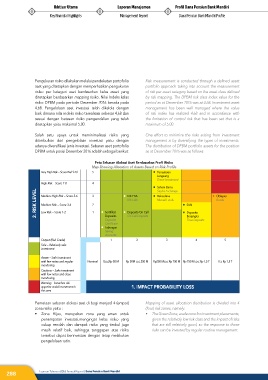

Pengukuran risiko dilakukan melalui pendekatan portofolio Risk measurement is conducted through a defined asset

aset yang ditetapkan dengan memperhatikan pengukuran portfolio approach taking into account the measurement

risiko per kategori aset berdasarkan kelas asset yang of risk per asset category based on the asset class defined

ditetapkan berdasarkan mapping risiko. Nilai Indeks kelas by risk mapping. The DPBM risk class index value for the

risiko DPBM pada periode Desember 2016 berada pada period as at December 2016 was at 4.68. Investment asset

4,68. Pengelolaan aset investasi telah dikelola dengan management has been well managed where the value

baik dimana nilai indeks risiko terealisasi sebesar 4,68 dan of risk index has realized 4.68 and in accordance with

sesuai dengan batasan risiko pengendalian yang telah the limitation of control risk that has been set that is a

ditetapkan yaitu maksimal 5,00. maximum of 5.00.

Salah satu upaya untuk meminimalisasi risiko yang One effort to minimize the risks arising from investment

ditimbulkan dari pengelolaan investasi yaitu dengan management is by diversifying the types of investments.

adanya diversifikasi jenis investasi. Sebaran aset portofolio The distribution of DPBM portfolio assets for the position

DPBM untuk posisi Desember 2016 adalah sebagai berikut: as at December 2016 was as follows:

Peta Sebaran Alokasi Aset Berdasarkan Profil Risiko

Map Showing Allocation of Assets Based on Risk Profile

Very High Risk – Score Risk 9-10 5 l Pernyataan

Langsung

Direct Investment

High Risk – Score 7-8 4

l Saham Bursa

2. RIsK LeveL Medium High Risk – Score 5-6 3 2 l KIK EBA l Reksadana l SUN l Obligasi

Stocks Exchange

Mutual Funds

Bonds

KIK EBA

Medium Risk – Score 3-4

Low Risk – Score 1-2

1

l Sertifikat

Deposito

On Call Deposits

Berjangka

Time Deposits

Deposits l Deposito On Call l Deposito

Certificate

l Tabungan

Saving

Accounts

Output (Risk Grade) 1 2 3 4 5

Safe – Relatively safe

investment

Aware – Safe investment

with few notes and regular Nominal 0≤x≤Rp 50 M Rp 50M ≤x≤ 250 M Rp250 M≤x≤ Rp 750 M Rp 750 M ≤x≤ Rp 1,5 T X ≥ Rp 1,5 T

monitoring

Cautions – Safe investment

with few notes and close

monitoring

Warning – breaches risk

appetite avoid investment in 1. ImpAcT pRObAbILITy LOss

this area

Pemetaan sebaran alokasi aset di bagi menjadi 4 (empat) Mapping of asset allocation distribution is divided into 4

zona risiko yaitu : (four) risk zones, namely:

• Zona Hijau, merupakan zona yang aman untuk • The Green Zone, a safe zone for investment placements,

penempatan investasi,mengingat kelas risiko yang given the relatively low risk class and the impact of risks

cukup rendah dan dampak risiko yang timbul juga that are still relatively good, so the response to those

masih relatif baik, sehingga tanggapan atas risiko risks can be invested by regular routine management.

tersebut dapat berinvestasi dengan tetap melakukan

pengelolaan rutin.

288 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri