Page 11 - AAG Benefits Guide OOS (Non-CA) Employees

P. 11

2021 10

BENEFITS

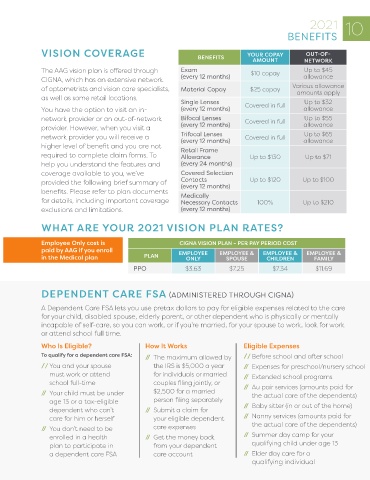

VISION COVERAGE BENEFITS YOUR COPAY NETWORK

OUT-OF-

AMOUNT

The AAG vision plan is offered through Exam $10 copay Up to $45

CIGNA, which has an extensive network (every 12 months) allowance

of optometrists and vision care specialists, Material Copay $25 copay Various allowance

amounts apply

as well as some retail locations.

Single Lenses Covered in full Up to $32

You have the option to visit an in- (every 12 months) allowance

network provider or an out-of-network Bifocal Lenses Covered in full Up to $55

provider. However, when you visit a (every 12 months) allowance

Up to $65

network provider you will receive a Trifocal Lenses Covered in full allowance

(every 12 months)

higher level of benefit and you are not Retail Frame

required to complete claim forms. To Allowance Up to $130 Up to $71

help you understand the features and (every 24 months)

coverage available to you, we’ve Covered Selection

provided the following brief summary of Contacts Up to $120 Up to $100

(every 12 months)

benefits. Please refer to plan documents Medically

for details, including important coverage Necessary Contacts 100% Up to $210

exclusions and limitations. (every 12 months)

WHAT ARE YOUR 2021 VISION PLAN RATES?

Employee Only cost is CIGNA VISION PLAN - PER PAY PERIOD COST

paid by AAG if you enroll EMPLOYEE EMPLOYEE & EMPLOYEE & EMPLOYEE &

in the Medical plan PLAN ONLY SPOUSE CHILDREN FAMILY

PPO $3.63 $7.25 $7.34 $11.69

DEPENDENT CARE FSA (ADMINISTERED THROUGH CIGNA)

A Dependent Care FSA lets you use pretax dollars to pay for eligible expenses related to the care

for your child, disabled spouse, elderly parent, or other dependent who is physically or mentally

incapable of self-care, so you can work, or if you’re married, for your spouse to work, look for work

or attend school full time.

Who Is Eligible? How It Works Eligible Expenses

To qualify for a dependent care FSA: // The maximum allowed by // Before school and after school

// You and your spouse the IRS is $5,000 a year // Expenses for preschool/nursery school

must work or attend for individuals or married // Extended school programs

school full-time couples filing jointly, or // Au pair services (amounts paid for

// Your child must be under $2,500 for a married the actual care of the dependents)

age 13 or a tax-eligible person filing separately // Baby sitter (in or out of the home)

dependent who can’t // Submit a claim for

care for him or herself your eligible dependent // Nanny services (amounts paid for

// You don’t need to be care expenses the actual care of the dependents)

enrolled in a health // Get the money back // Summer day camp for your

plan to participate in from your dependent qualifying child under age 13

a dependent care FSA care account // Elder day care for a

qualifying individual