Page 67 - QEB_2_2016_lowres

P. 67

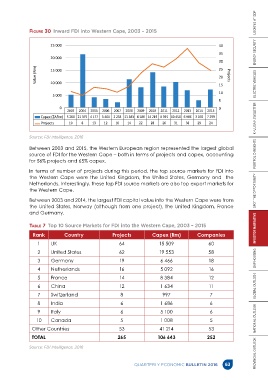

Figure 30 Inward FDI into Western Cape, 2003 – 2015

25 000 40

35

20 000

30

Value (Rm) 15 000 25 Projects

20

10 000

15

10

5 000

5

0 0

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Capex (ZARm) 5 260 21 375 4 177 3 404 2 233 11 583 8 180 14 219 8 391 10 450 6 986 3 076 7 299

Projects 10 8 13 12 10 14 22 28 26 31 38 29 24

Source: FDI Intelligence, 2016

Between 2003 and 2015, the Western European region represented the largest global

source of FDI for the Western Cape – both in terms of projects and capex, accounting

for 56% projects and 65% capex.

In terms of number of projects during this period, the top source markets for FDI into

the Western Cape were the United Kingdom, the United States, Germany and the

Netherlands. Interestingly, these top FDI source markets are also top export markets for

the Western Cape. PROVINCIAL OUTLOOK NATIONAL OUTLOOK GLOBAL OUTLOOK GAP HOUSING INVESTOR NARRATIVE SPOT THE OPPORTUNITY PORTFOLIO INSIGHTS KHULISA NEWSLETTER ELECTRIC VEHICLES ENERGY SECURITY LOOKING AT GDP

Between 2003 and 2014, the largest FDI capital value into the Western Cape were from

the United States, Norway (although from one project), the United Kingdom, France

and Germany.

Table 7 Top 10 Source Markets for FDI into the Western Cape, 2003 – 2015

Rank Country Projects Capex (Rm) Companies

1 UK 64 15 509 60

2 United States 62 19 553 58

3 Germany 19 6 466 18

4 Netherlands 16 5 092 16

5 France 14 8 384 12

6 China 12 1 634 11

7 Switzerland 8 997 7

8 India 6 1 686 6

9 Italy 6 5 100 6

10 Canada 5 1 008 5

Other Countries 53 41 214 53

TOTAL 265 106 643 252

Source: FDI Intelligence, 2016

QUARTERLY ECONOMIC BULLETIN 2016 63