Page 4 - Bay_County_Townhouses_and_Condos_2017-Q2_Detail_Neat

P. 4

Quarterly Market Detail - Q2 2017

Townhouses and Condos

Bay County

Percent Change

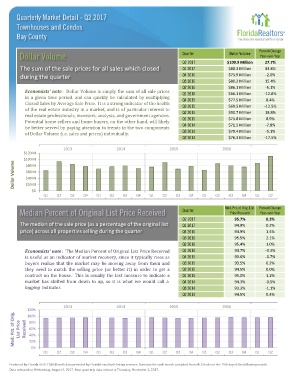

Dollar Volume Quarter Dollar Volume Year-over-Year

Q2 2017 $109.9 Million 27.7%

The sum of the sale prices for all sales which closed Q1 2017 $88.3 Million 33.8%

during the quarter Q4 2016 $75.9 Million -2.0%

Q3 2016 $80.2 Million 15.4%

Q2 2016 $86.1 Million -5.1%

Economists' note : Dollar Volume is simply the sum of all sale prices Q1 2016 $66.1 Million -12.8%

in a given time period, and can quickly be calculated by multiplying

Closed Sales by Average Sale Price. It is a strong indicator of the health Q4 2015 $77.5 Million 8.4%

of the real estate industry in a market, and is of particular interest to Q3 2015 $69.5 Million -12.5%

real estate professionals, investors, analysts, and government agencies. Q2 2015 $90.7 Million 18.8%

Potential home sellers and home buyers, on the other hand, will likely Q1 2015 $75.8 Million 8.9%

be better served by paying attention to trends in the two components Q4 2014 $71.5 Million -7.8%

of Dollar Volume (i.e. sales and prices) individually. Q3 2014 $79.4 Million -5.1%

Q2 2014 $76.3 Million -17.5%

2013 2014 2015 2016

$120 M

$100 M

Dollar Volume $60 M

$80 M

$40 M

$20 M

$0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

Med. Pct. of Orig. List Percent Change

Median Percent of Original List Price Received Quarter Price Received Year-over-Year

Q2 2017 95.7% 0.3%

The median of the sale price (as a percentage of the original list Q1 2017 94.9% 0.2%

price) across all properties selling during the quarter Q4 2016 94.9% 1.4%

Q3 2016 95.5% 2.1%

Q2 2016 95.4% 1.0%

Economists' note : The Median Percent of Original List Price Received Q1 2016 94.7% -0.3%

is useful as an indicator of market recovery, since it typically rises as Q4 2015 93.6% -0.7%

buyers realize that the market may be moving away from them and Q3 2015 93.5% 0.2%

they need to match the selling price (or better it) in order to get a Q2 2015 94.5% 0.0%

contract on the house. This is usually the last measure to indicate a Q1 2015 95.0% 1.2%

market has shifted from down to up, so it is what we would call a Q4 2014 94.3% -0.5%

lagging indicator. Q3 2014 93.3% -1.1%

Q2 2014 94.5% 0.4%

2013 2014 2015 2016

120%

Med. Pct. of Orig. List Price Received 80%

100%

60%

40%

20%

0%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month.

Data released on Wednesday, August 9, 2017. Next quarterly data release is Thursday, November 2, 2017.