Page 45 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 45

• 43

Investments

Investments reduced by $0.6 billion, the net effect of decreases of $0.8 billion in Trinidad and Tobago, $0.3 billion in BVI, and $0.2

billion in Cayman Islands, with smaller variances in other countries. These declines were offset by increases in Ghana and Guyana

of $0.7 billion and $0.4 billion respectively.

Deposits and other funding instruments

Deposits and other funding instruments, the Group’s main source of liquidity, increased by $7.3 billion or 7.4 percent over the prior

year. This growth was recorded across the group with all subsidiaries seeing increases in deposits and other funding instruments.

Total equity

Total equity as at September 30, 2025, increased by $1.1 billion or 7.3 percent from the prior year, the net effect of profits and dividend

payments. The Group’s capital adequacy ratio remains robust at 14.88 percent (Basel II) at September 30, 2025, underscoring the

Group’s ability to maintain adequate capital levels.

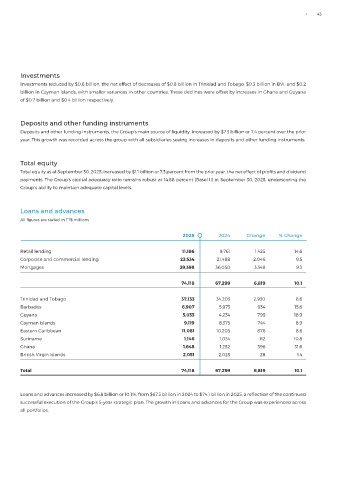

Loans and advances

All figures are stated in TT$ millions

2025 2024 Change % Change

Retail lending 11,186 9,761 1,425 14.6

Corporate and commercial lending 23,534 21,488 2,046 9.5

Mortgages 39,398 36,050 3,348 9.3

74,118 67,299 6,819 10.1

Trinidad and Tobago 37,133 34,203 2,930 8.6

Barbados 6,907 5,973 934 15.6

Guyana 5,033 4,234 799 18.9

Cayman Islands 9,119 8,375 744 8.9

Eastern Caribbean 11,081 10,205 876 8.6

Suriname 1,146 1,034 112 10.8

Ghana 1,648 1,252 396 31.6

British Virgin Islands 2,051 2,023 28 1.4

Total 74,118 67,299 6,819 10.1

Loans and advances increased by $6.8 billion or 10.1%, from $67.3 billion in 2024 to $74.1 billion in 2025, a reflection of the continued

successful execution of the Group’s 5-year strategic plan. The growth in Loans and advances for the Group was experienced across

all portfolios.