Page 41 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 41

• 39

• The subsidiaries in the Eastern Caribbean recorded growth in Net interest income

by $34 million due to increases in Interest income of $45 million which was offset The Group’s capital position,

by an increase in interest expense, of $11 million. The increase in Interest income liquidity buffers, and asset

resulted from higher Advances relative to the prior year. quality remain strong,

• Ghana’s recorded growth in Net interest income of $76 million is mainly due to allowing us to prudently

higher Interest income. This was driven by increased portfolios for liquid assets, support credit expansion in

loans and investments, combined with higher interest rates on loans.

key sectors that contribute to

sustainable economic growth.

We will continue to focus on

cost discipline and portfolio

diversification.

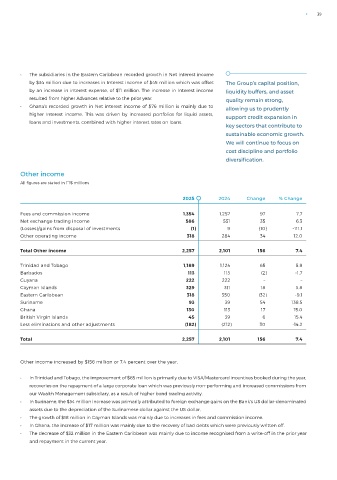

Other income

All figures are stated in TT$ millions

2025 2024 Change % Change

Fees and commission income 1,354 1,257 97 7.7

Net exchange trading income 586 551 35 6.3

(Losses)/gains from disposal of investments (1) 9 (10) -111.1

Other operating income 318 284 34 12.0

Total Other income 2,257 2,101 156 7.4

Trinidad and Tobago 1,189 1,124 65 5.8

Barbados 113 115 (2) -1.7

Guyana 222 222 – –

Cayman Islands 329 311 18 5.8

Eastern Caribbean 318 350 (32) -9.1

Suriname 93 39 54 138.5

Ghana 130 113 17 15.0

British Virgin Islands 45 39 6 15.4

Less eliminations and other adjustments (182) (212) 30 -14.2

Total 2,257 2,101 156 7.4

Other income increased by $156 million or 7.4 percent over the year.

• In Trinidad and Tobago, the improvement of $65 million is primarily due to VISA/Mastercard incentives booked during the year,

recoveries on the repayment of a large corporate loan which was previously non-performing and increased commissions from

our Wealth Management subsidiary, as a result of higher bond trading activity.

• In Suriname, the $54 million increase was primarily attributed to foreign exchange gains on the Bank’s US dollar-denominated

assets due to the depreciation of the Surinamese dollar against the US dollar.

• The growth of $18 million in Cayman Islands was mainly due to increases in fees and commission income.

• In Ghana, the increase of $17 million was mainly due to the recovery of bad debts which were previously written off.

• The decrease of $32 million in the Eastern Caribbean was mainly due to income recognised from a write-off in the prior year

and repayment in the current year.