Page 44 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 44

42 • Republic Financial Holdings Limited 2025 Annual Report • EXECUTIVE REPORTS

Group President and CEO’s Discussion and Analysis

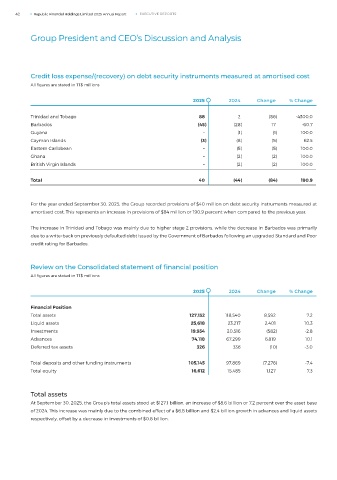

Credit loss expense/(recovery) on debt security instruments measured at amortised cost

All figures are stated in TT$ millions

2025 2024 Change % Change

Trinidad and Tobago 88 2 (86) -4300.0

Barbados (45) (28) 17 -60.7

Guyana – (1) (1) 100.0

Cayman Islands (3) (8) (5) 62.5

Eastern Caribbean – (5) (5) 100.0

Ghana – (2) (2) 100.0

British Virgin Islands – (2) (2) 100.0

Total 40 (44) (84) 190.9

For the year ended September 30, 2025, the Group recorded provisions of $40 million on debt security instruments measured at

amortised cost. This represents an increase in provisions of $84 million or 190.9 percent when compared to the previous year.

The increase in Trinidad and Tobago was mainly due to higher stage 2 provisions, while the decrease in Barbados was primarily

due to a write-back on previously defaulted debt issued by the Government of Barbados following an upgraded Standard and Poor

credit rating for Barbados.

Review on the Consolidated statement of financial position

All figures are stated in TT$ millions

2025 2024 Change % Change

Financial Position

Total assets 127,132 118,540 8,592 7.2

Liquid assets 25,618 23,217 2,401 10.3

Investments 19,934 20,516 (582) -2.8

Advances 74,118 67,299 6,819 10.1

Deferred tax assets 326 336 (10) -3.0

Total deposits and other funding instruments 105,145 97,869 (7,276) -7.4

Total equity 16,612 15,485 1,127 7.3

Total assets

At September 30, 2025, the Group’s total assets stood at $127.1 billion, an increase of $8.6 billion or 7.2 percent over the asset base

of 2024. This increase was mainly due to the combined effect of a $6.8 billion and $2.4 billion growth in advances and liquid assets

respectively, offset by a decrease in investments of $0.6 billion.