Page 40 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 40

38 • Republic Financial Holdings Limited 2025 Annual Report • EXECUTIVE REPORTS

Group President and CEO’s Discussion and Analysis

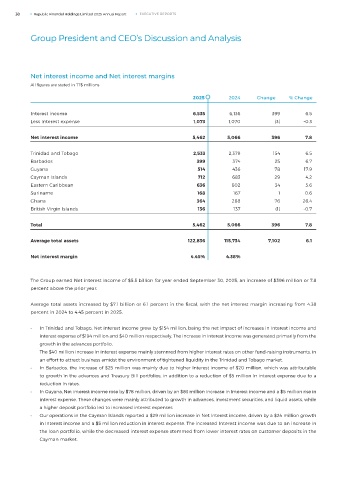

Net interest income and Net interest margins

All figures are stated in TT$ millions

2025 2024 Change % Change

Interest income 6,535 6,136 399 6.5

Less Interest expense 1,073 1,070 (3) -0.3

Net interest income 5,462 5,066 396 7.8

Trinidad and Tobago 2,533 2,379 154 6.5

Barbados 399 374 25 6.7

Guyana 514 436 78 17.9

Cayman Islands 712 683 29 4.2

Eastern Caribbean 636 602 34 5.6

Suriname 168 167 1 0.6

Ghana 364 288 76 26.4

British Virgin Islands 136 137 (1) -0.7

Total 5,462 5,066 396 7.8

Average total assets 122,836 115,734 7,102 6.1

Net interest margin 4.45% 4.38%

The Group earned Net interest income of $5.5 billion for year ended September 30, 2025, an increase of $396 million or 7.8

percent above the prior year.

Average total assets increased by $7.1 billion or 6.1 percent in the fiscal, with the net interest margin increasing from 4.38

percent in 2024 to 4.45 percent in 2025.

• In Trinidad and Tobago, Net interest income grew by $154 million, being the net impact of increases in Interest income and

interest expense of $194 million and $40 million respectively. The increase in Interest income was generated primarily from the

growth in the advances portfolio.

The $40 million increase in interest expense mainly stemmed from higher interest rates on other fund-raising instruments, in

an effort to attract business amidst the environment of tightened liquidity in the Trinidad and Tobago market.

• In Barbados, the increase of $25 million was mainly due to higher Interest income of $20 million, which was attributable

to growth in the advances and Treasury Bill portfolios, in addition to a reduction of $5 million in interest expense due to a

reduction in rates.

• In Guyana, Net interest income rose by $78 million, driven by an $83 million increase in Interest income and a $5 million rise in

interest expense. These changes were mainly attributed to growth in advances, investment securities, and liquid assets, while

a higher deposit portfolio led to increased interest expenses.

• Our operations in the Cayman Islands reported a $29 million increase in Net Interest income, driven by a $24 million growth

in Interest income and a $5 million reduction in interest expense. The increased Interest income was due to an increase in

the loan portfolio, while the decreased interest expense stemmed from lower interest rates on customer deposits in the

Cayman market.