Page 43 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 43

• 41

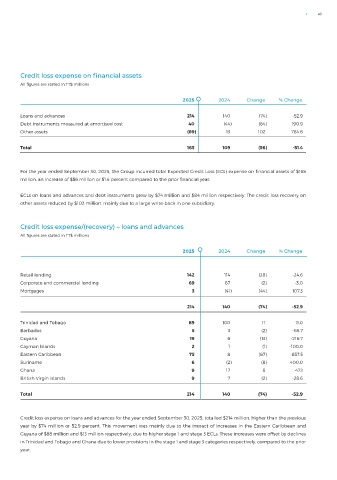

Credit loss expense on financial assets

All figures are stated in TT$ millions

2025 2024 Change % Change

Loans and advances 214 140 (74) -52.9

Debt instruments measured at amortised cost 40 (44) (84) 190.9

Other assets (89) 13 102 784.6

Total 165 109 (56) -51.4

For the year ended September 30, 2025, the Group incurred total Expected Credit Loss (ECL) expense on financial assets of $165

million, an increase of $56 million or 51.4 percent compared to the prior financial year.

ECLs on loans and advances and debt instruments grew by $74 million and $84 million respectively. The credit loss recovery on

other assets reduced by $102 million, mainly due to a large write-back in one subsidiary.

Credit loss expense/(recovery) – loans and advances

All figures are stated in TT$ millions

2025 2024 Change % Change

Retail lending 142 114 (28) -24.6

Corporate and commercial lending 69 67 (2) -3.0

Mortgages 3 (41) (44) 107.3

214 140 (74) -52.9

Trinidad and Tobago 89 100 11 11.0

Barbados 5 3 (2) -66.7

Guyana 19 6 (13) -216.7

Cayman Islands 2 1 (1) -100.0

Eastern Caribbean 75 8 (67) -837.5

Suriname 6 (2) (8) 400.0

Ghana 9 17 8 47.1

British Virgin Islands 9 7 (2) -28.6

Total 214 140 (74) -52.9

Credit loss expense on loans and advances for the year ended September 30, 2025, totalled $214 million, higher than the previous

year by $74 million or 52.9 percent. This movement was mainly due to the impact of increases in the Eastern Caribbean and

Guyana of $88 million and $13 million respectively, due to higher stage 1 and stage 3 ECLs. These increases were offset by declines

in Trinidad and Tobago and Ghana due to lower provisions in the stage 1 and stage 3 categories respectively, compared to the prior

year.