Page 8 - RS&A Benefits Enrollments Guide

P. 8

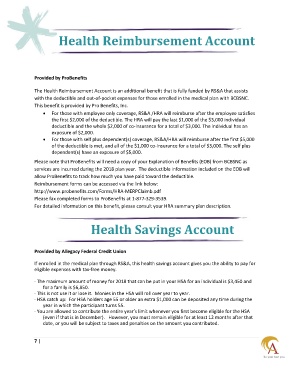

Health Reimbursement Account

Provided by ProBenefits

The Health Reimbursement Account is an additional benefit that is fully funded by RS&A that assists

with the deductible and out-of-pocket expenses for those enrolled in the medical plan with BCBSNC.

This benefit is provided by Pro Benefits, Inc.

For those with employee only coverage, RS&A /HRA will reimburse after the employee satisfies

the first $2,000 of the deductible. The HRA will pay the last $1,000 of the $3,000 individual

deductible and the whole $2,000 of co-insurance for a total of $3,000. The individual has an

exposure of $2,000.

For those with self plus dependent(s) coverage, RS&A/HRA will reimburse after the first $5,000

of the deductible is met, and all of the $1,000 co-insurance for a total of $3,000. The self plus

dependent(s) have an exposure of $5,000.

Please note that ProBenefits will need a copy of your Explanation of Benefits (EOB) from BCBSNC as

services are incurred during the 2018 plan year. The deductible information included on the EOB will

allow ProBenefits to track how much you have paid toward the deductible.

Reimbursement forms can be accessed via the link below:

http://www.probenefits.com/Forms/HRA-MERPClaimb.pdf

Please fax completed forms to ProBenefits at 1-877-329-3539.

For detailed information on this benefit, please consult your HRA summary plan description.

Health Savings Account

Provided by Allegacy Federal Credit Union

If enrolled in the medical plan through RS&A, this health savings account gives you the ability to pay for

eligible expenses with tax-free money.

· The maximum amount of money for 2018 that can be put in your HSA for an individual is $3,450 and

for a family is $6,850.

· This is not use it or lose it. Monies in the HSA will roll over year to year.

· HSA catch up: For HSA holders age 55 or older an extra $1,000 can be deposited any time during the

year in which the participant turns 55.

· You are allowed to contribute the entire year’s limit whenever you first become eligible for the HSA

(even if that is in December). However, you must remain eligible for at least 12 months after that

date, or you will be subject to taxes and penalties on the amount you contributed.

7 |