Page 53 - Futr Investment Proposal

P. 53

53

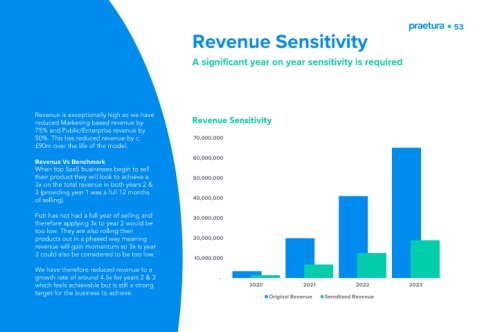

Revenue Sensitivity

A significant year on year sensitivity is required

Revenue is exceptionally high so we have

reduced Marketing based revenue by Revenue Sensitivity

75% and Public/Enterprise revenue by

50%. This has reduced revenue by c. 70,000,000

£90m over the life of the model.

Revenue Vs Benchmark 60,000,000

When top SaaS businesses begin to sell

their product they will look to achieve a 50,000,000

3x on the total revenue in both years 2 &

3 (providing year 1 was a full 12 months

of selling). 40,000,000

Futr has not had a full year of selling and 30,000,000

therefore applying 3x to year 2 would be

too low. They are also rolling their

products out in a phased way meaning 20,000,000

revenue will gain momentum so 3x is year

3 could also be considered to be too low.

10,000,000

We have therefore reduced revenue to a

growth rate of around 4.5x for years 2 & 3 -

which feels achievable but is still a strong 2020 2021 2022 2023

target for the business to achieve.

Original Revenue Sensitised Revenue