Page 6 - Module 14 Pattern Formations

P. 6

Module 14 – Pattern Formations

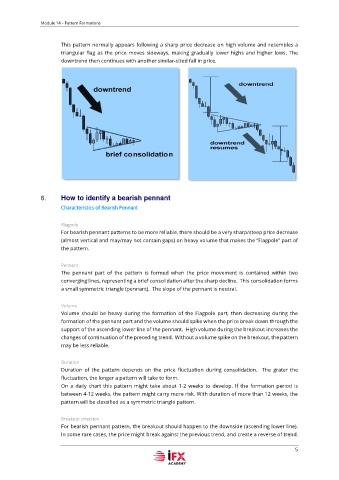

This pattern normally appears following a sharp price decrease on high volume and resembles a

triangular flag as the price moves sideways, making gradually lower highs and higher lows. The

downtrend then continues with another similar-sized fall in price.

6. How to identify a bearish pennant

Characteristics of Bearish Pennant

Flagpole

For bearish pennant patterns to be more reliable, there should be a very sharp/steep price decrease

(almost vertical and may/may not contain gaps) on heavy volume that makes the “Flagpole” part of

the pattern.

Pennant

The pennant part of the pattern is formed when the price movement is contained within two

converging lines, representing a brief consolidation after the sharp decline. This consolidation forms

a small symmetric triangle (pennant). The slope of the pennant is neutral.

Volume

Volume should be heavy during the formation of the Flagpole part, then decreasing during the

formation of the pennant part and the volume should spike when the price break down through the

support of the ascending lower line of the pennant. High volume during the breakout increases the

changes of continuation of the preceding trend. Without a volume spike on the breakout, the pattern

may be less reliable.

Duration

Duration of the pattern depends on the price fluctuation during consolidation. The grater the

fluctuation, the longer a pattern will take to form.

On a daily chart this pattern might take about 1-2 weeks to develop. If the formation period is

between 4-12 weeks, the pattern might carry more risk. With duration of more than 12 weeks, the

pattern will be classified as a symmetric triangle pattern.

Breakout direction

For bearish pennant pattern, the breakout should happen to the downside (ascending lower line).

In some rare cases, the price might break against the previous trend, and create a reverse of trend.

5