Page 10 - Module 14 Pattern Formations

P. 10

Module 14 – Pattern Formations

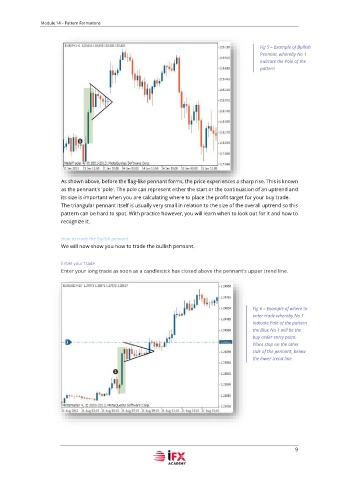

Fig 5 – Example of Bullish

Pennant, whereby No 1

indicate the Pole of the

pattern

As shown above, before the flag-like pennant forms, the price experiences a sharp rise. This is known

as the pennant's 'pole'. The pole can represent either the start or the continuation of an uptrend and

its size is important when you are calculating where to place the profit target for your buy trade.

The triangular pennant itself is usually very small in relation to the size of the overall uptrend so this

pattern can be hard to spot. With practice however, you will learn when to look out for it and how to

recognize it.

How to trade the bullish pennant

We will now show you how to trade the bullish pennant.

Enter your trade

Enter your long trade as soon as a candlestick has closed above the pennant's upper trend line.

Fig 6 – Example of where to

enter trade whereby No 1

indicate Pole of the pattern

the Blue No 1 will be the

buy order entry point.

Place stop on the other

side of the pennant, below

the lower trend line

9