Page 15 - Module 14 Pattern Formations

P. 15

Module 14 – Pattern Formations

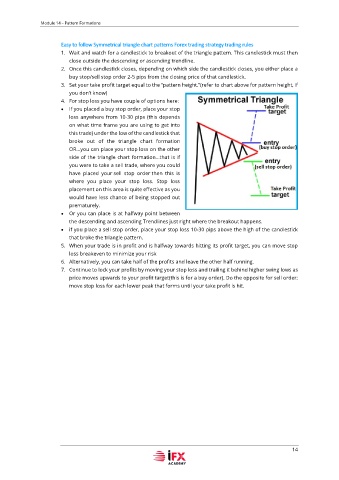

Easy to follow Symmetrical triangle chart patterns Forex trading strategy trading rules

1. Wait and watch for a candlestick to breakout of the triangle pattern. This candlestick must then

close outside the descending or ascending trendline.

2. Once this candlestick closes, depending on which side the candlestick closes, you either place a

buy stop/sell stop order 2-5 pips from the closing price of that candlestick.

3. Set your take profit target equal to the “pattern height.”(refer to chart above for pattern height, if

you don’t know)

4. For stop loss you have couple of options here:

• If you placed a buy stop order, place your stop

loss anywhere from 10-30 pips (this depends

on what time frame you are using to get into

this trade) under the low of the candlestick that

broke out of the triangle chart formation

OR…you can place your stop loss on the other

side of the triangle chart formation…that is if

you were to take a sell trade, where you could

have placed your sell stop order then this is

where you place your stop loss. Stop loss

placement on this area is quite effective as you

would have less chance of being stopped out

prematurely.

• Or you can place is at halfway point between

the descending and ascending Trendlines just right where the breakout happens.

• if you place a sell stop order, place your stop loss 10-30 pips above the high of the candlestick

that broke the triangle pattern.

5. When your trade is in profit and is halfway towards hitting its profit target, you can move stop

loss breakeven to minimize your risk

6. Alternatively, you can take half of the profits and leave the other half running.

7. Continue to lock your profits by moving your stop loss and trailing it behind higher swing lows as

price moves upwards to your profit target(this is for a buy order). Do the opposite for sell order:

move stop loss for each lower peak that forms until your take profit is hit.

14