Page 11 - Module 14 Pattern Formations

P. 11

Module 14 – Pattern Formations

Place your profit target

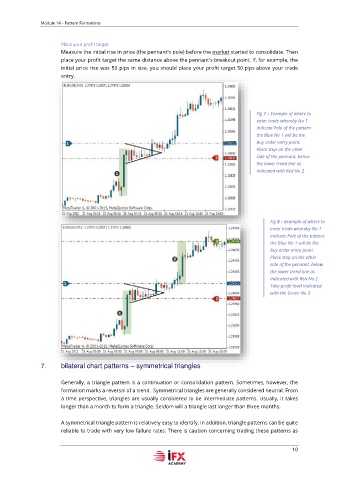

Measure the initial rise in price (the pennant's pole) before the market started to consolidate. Then

place your profit target the same distance above the pennant's breakout point. If, for example, the

initial price rise was 50 pips in size, you should place your profit target 50 pips above your trade

entry.

Fig 7 – Example of where to

enter trade whereby No 1

indicate Pole of the pattern

the Blue No 1 will be the

buy order entry point.

Place stop on the other

side of the pennant, below

the lower trend line as

indicated with Red No 2

Fig 8 – Example of where to

enter trade whereby No 1

indicate Pole of the pattern

the Blue No 1 will be the

buy order entry point.

Place stop on the other

side of the pennant, below

the lower trend line as

indicated with Red No 2.

Take profit level indicated

with the Green No 3

7. bilateral chart patterns – symmetrical triangles

Generally, a triangle pattern is a continuation or consolidation pattern. Sometimes, however, the

formation marks a reversal of a trend. Symmetrical triangles are generally considered neutral. From

a time perspective, triangles are usually considered to be intermediate patterns. Usually, it takes

longer than a month to form a triangle. Seldom will a triangle last longer than three months.

A symmetrical triangle pattern is relatively easy to identify. In addition, triangle patterns can be quite

reliable to trade with very low failure rates. There is caution concerning trading these patterns as

10