Page 10 - 2015 Best Practices of Spectacle Lens Management

P. 10

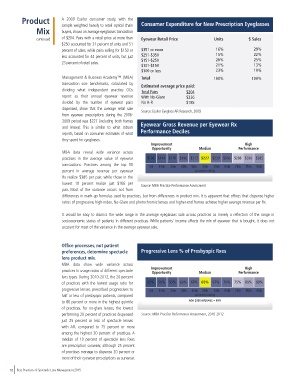

Product A 2009 Essilor consumer study, with the Consumer Expenditure for New Prescription Eyeglasses

Mix sample weighted heavily to retail optical chain

buyers, shows an average eyeglasses transaction

continued of $204. Pairs with a retail price at more than Eyewear Retail Price Units $ Sales

$250 accounted for 31 percent of units and 51

percent of sales, while pairs selling for $150 or $351 or more 16% 29%

less accounted for 44 percent of units, but just $251-$350 15% 22%

26%

25%

23 percent of retail sales. $151-$250

$101-$150 21% 13%

$100 or less 23% 10%

Management & Business Academy™ (MBA) Total 100% 100%

transaction size benchmarks, calculated by Estimated average price paid:

dividing what independent practice ODs Total Pairs $204

report as their annual eyewear revenue With No-Glare $236

divided by the number of eyewear pairs No A-R $185

dispensed, show that the average retail sale

Source: Essilor Eyeglass AR Research, 2009

from eyewear prescriptions during the 2006-

2009 period was $227 (including both frames

and lenses). This is similar to what Jobson Eyewear Gross Revenue per Eyewear Rx

reports, based on consumer estimates of what Performance Deciles

they spend for eyeglasses.

Improvement High

Opportunity Median Performance

MBA data reveal wide variance across

practices in the average value of eyewear $106 $149 $176 $196 $213 $227 $239 $260 $288 $320 $385

transactions. Practices among the top 10 5th 15th 25th 35th 45th 50th 55th 65th 75th 85th 95th

percent in average revenue per eyewear percentile ranking

Rx realize $385 per pair, while those in the

lowest 10 percent realize just $106 per

Source: MBA Practice Performance Assessment

pair. Most of the variance occurs not from

differences in mark-up formulas used by practices, but from differences in product mix. It is apparent that offices that dispense higher

ratios of progressive, high-index, No-Glare and photochromic lenses and higher-end frames achieve higher average revenue per Rx.

It would be easy to dismiss the wide range in the average eyeglasses sale across practices as merely a reflection of the range in

socioeconomic status of patients in different practices. While patients’ income affects the mix of eyewear that is bought, it does not

account for most of the variance in the average eyewear sale.

Office processes, not patient

preferences, determine spectacle Progressive Lens % of Presbyopic Rxes

lens product mix.

MBA data show wide variance across

High

practices in usage ratios of different spectacle Improvement Median Performance

Opportunity

lens types. During 2010-2012, the 20 percent

of practices with the lowest usage ratio for 35% 50% 53% 60% 63% 65% 67% 70% 75% 80% 89%

progressive lenses, prescribed progressives to 5th 15th 25th 35th 45th 50th 55th 65th 75th 85th 95th

half or less of presbyopic patients, compared percentile ranking

to 80 percent or more in the highest quintile AOA 2008 AVERAGE = 60%

of practices. For no-glare lenses, the lowest

performing 20 percent of practices dispensed Source: MBA Practice Performance Assessment, 2010-2012

just 25 percent or less of spectacle lenses

with AR, compared to 75 percent or more

among the highest 20 percent of practices. A

median of 10 percent of spectacle lens Rxes

are prescription sunwear, although 25 percent

of practices manage to dispense 20 percent or

more of their eyewear prescriptions as sunwear.

10 Best Practices of Spectacle Lens Management 2015