Page 29 - 2015 Best Practices of Spectacle Lens Management

P. 29

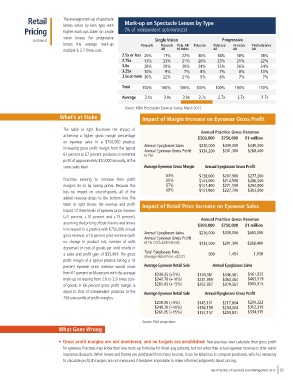

Retail The average mark-up of spectacle Mark-up on Spectacle Lenses by Type

Pricing lenses varies by lens type with (% of independent optometrists)

higher mark-ups taken on single

vision lenses. For progressive

continued Single Vision Progressive

lenses the average mark-up Polycarb Polycarb Poly AR Polycarb Polycarb Hi-index Photochromic

multiple is 2.7 times cost. AR Hi-Index AR AR AR

2.5x or less 20% 17% 22% 36% 38% 38% 38%

2.75x 13% 23% 21% 26% 23% 21% 22%

3.0x 28% 29% 30% 24% 25% 26% 24%

3.25x 10% 9% 7% 8% 7% 8% 10%

3.5x or more 30% 22% 21% 5% 6% 7% 7%

Total 100% 100% 100% 100% 100% 100% 100%

Average 3.1x 3.0x 3.0x 2.7x 2.7x 2.7x 2.7x

Source: MBA Prescription Eyewear Survey, March 2012

What’s at Stake Impact of Margin Increase on Eyewear Gross Profit

The table at right illustrates the impact of Annual Practice Gross Revenue

achieving a higher gross margin percentage $500,000 $750,000 $1 million

on eyewear sales. In a $750,000 practice,

increasing gross profit margin from the typical Annual Eyeglasses Sales $220,000 $330,000 $440,000

$201,300

$268,400

$134,200

Annual Eyewear Gross Profit

61 percent to 67 percent produces incremental (61%)

profit of approximately $20,000 annually, at the

same sales level. Average Eyewear Gross Margin Annual Eyeglasses Gross Profit

63% $138,600 $207,900 $277,200

Practices seeking to increase their profit 65% $143,000 $214,500 $286,000

margins do so by raising prices. Because this 67% $147,400 $221,100 $294,800

has no impact on cost-of-goods, all of the 69% $151,800 $227,700 $303,600

added revenue drops to the bottom line. The

table at right shows the revenue and profit Impact of Retail Price Increase on Eyewear Sales

impact of three levels of eyewear price increase

Source: Essilor AR Coating Pricing Survey-Independent Versus Retail Chain, 2007 (+5 percent, +10 percent and +15 percent), Annual Practice Gross Revenue

assuming that pricing of both frames and lenses $500,000 $750,000 $1 million

is increased. In a practice with $750,000 annual

gross revenue, a 10 percent price increase (with Annual Eyeglasses Sales $220,000 $330,000 $440,000

Annual Eyewear Gross Profit

no change in product mix, number of units (61% COG=$88.54/unit) $134,000 $201,300 $268,400

dispensed or cost-of goods per unit) results in

a sales and profit gain of $33,064. The gross Total Eyeglasses Pairs 969 1,454 1,938

(Average Retail Price =$227)

profit margin of a typical practice taking a 10

percent eyewear price increase would move Average Eyewear Retail Sale Annual Eyeglasses Sales

from 61 percent to 66 percent with the average $238.35 (+5%) $130,961 $346,561 $461,922

mark-up increasing from 2.6 to 2.9 times cost- $249.70 (+10%) $241,959 $363,064 $483,919

of-goods. A 66 percent gross profit margin is $261.05 (+15%) $252,957 $379,567 $505,915

equal to that of independent practices at the Average Eyewear Retail Sale Annual Eyeglasses Gross Profit

75th percentile of profit margins.

$238.35 (+5%) $145,161 $217,864 $290,322

$249.70 (+10%) $156,159 $234,364 $312,319

$261.05 (+15%) $167,157 $250,831 $334,315

Source: PAA projections

What Goes Wrong

• Gross profit margins are not monitored, and no targets are established. Few practices ever calculate their gross profit

for eyewear. Practices may know their lens mark-up formulas for direct-pay patients, but not what their actual eyewear revenue is after vision

insurance discounts. When lenses and frames are purchased from many sources, it can be laborious to compute purchases, which is necessary

to calculate profit. If margins are not measured, it becomes impossible to make informed judgments about pricing.

Best Practices of Spectacle Lens Management 2015 29