Page 28 - 2015 Best Practices of Spectacle Lens Management

P. 28

Retail Effective management of eyewear retail pricing can have a major impact on practice profitability. If prices are set too low, profit margins suffer, and Retail

Pricing money is left on the table. If prices are too high, patients are more likely to search for lower prices at alternative providers, and the capture rate of Pricing

patients’ lens purchases declines.

A consensus among consultants who have analyzed the retail pricing of their independent OD clients is that there is a tendency to under-price eyewear. This

reflects an overblown OD fear of losing business to discount optical chains. Because ODs do not know the price that will scare away patients, many set prices

lower than necessary. Consultants note that it’s impossible for a small business with a high service model to match Walmart’s prices and still make money.

There is no evidence that independents cannot retain a high share of their patients’ eyewear purchases, while pricing lenses at a premium to discount optical

chains. A more aggressive pricing strategy will work in most optometric practices.

In every practice there is a small segment of patients whose primary consideration when selecting eyewear is price. These patients may be quite vocal in

expressing their desire for a low price. But it makes no sense for a practice to set prices low and accept poor margins to satisfy the desires of a vocal minority.

For most patients of independent ECPs, price is not the most important consideration as they buy eyewear. Most patients expect to pay more for the higher

level of care they receive at an independent eye doctor and expect to pay more for their eyeglasses as well. They are willing to pay more both to maintain

the relationship with the doctor and for the convenience of having an exam and buying vision care devices at the same time and place.

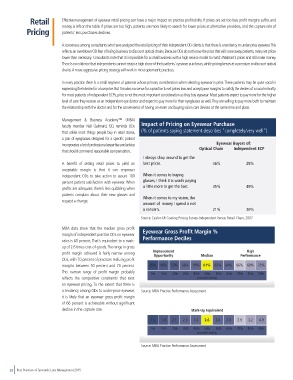

Management & Business Academy™ (MBA)

faculty member Neil Gailmard, OD, reminds ODs Impact of Pricing on Eyewear Purchase

that unlike most things people buy in retail stores, (% of patients saying statement describes “completely/very well”)

a pair of eyeglasses designed for a specific patient

incorporates a lot of professional expertise and advice Eyewear Buyers of:

that should command reasonable compensation. Optical Chain Independent ECP

I always shop around to get the

A benefit of setting retail prices to yield an best prices. 46% 28%

acceptable margin is that it can empower

independent ODs to take action to assure 100 When it comes to buying

percent patient satisfaction with eyewear. When glasses, I think it is worth paying

profits are adequate, there’s less quibbling when a little more to get the best. 35% 49%

patients complain about their new glasses and

request a change. When it comes to my vision, the

amount of money I spend is not

a concern. 21% 30%

Source: Essilor AR Coating Pricing Survey-Independent Versus Retail Chain, 2007

MBA data show that the median gross profit

margin of independent practice ODs on eyewear Eyewear Gross Profit Margin %

sales is 61 percent. That’s equivalent to a mark- Performance Deciles

up of 2.6 times cost-of-goods. The range in gross

High

profit margin achieved is fairly narrow among Improvement Median Performance

Opportunity

ODs, with 70 percent of practices realizing profit

margins between 50 percent and 70 percent. 35% 48% 53% 56% 59% 61% 62% 64% 66% 69% 75%

This narrow range of profit margin probably 5th 15th 25th 35th 45th 50th 55th 65th 75th 85th 95th

reflects the competitive constraints that exist percentile ranking

on eyewear pricing. To the extent that there is

a tendency among ODs to under-price eyewear, Source: MBA Practice Performance Assessment

it is likely that an eyewear gross profit margin

of 66 percent is achievable without significant

decline in the capture rate. Mark-Up Equivalent

1.5 1.9 2.1 2.3 2.4 2.6 2.6 2.8 2.9 3.2 4.9

5th 15th 25th 35th 45th 50th 55th 65th 75th 85th 95th

percentile ranking

Source: MBA Practice Performance Assessment

28 Best Practices of Spectacle Lens Management 2015