Page 287 - VIRANSH COACHING CLASSES

P. 287

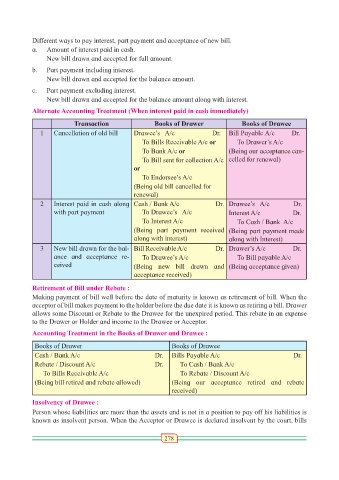

Different ways to pay interest, part payment and acceptance of new bill.

a. Amount of interest paid in cash.

New bill drawn and accepted for full amount.

b. Part payment including interest.

New bill drawn and accepted for the balance amount.

c. Part payment excluding interest.

New bill drawn and accepted for the balance amount along with interest.

Alternate Accounting Treatment (When interest paid in cash immediately)

Transaction Books of Drawer Books of Drawee

1 Cancellation of old bill Drawee’s A/c Dr. Bill Payable A/c Dr.

To Bills Receivable A/c or To Drawer’s A/c

To Bank A/c or (Being our acceptance can-

To Bill sent for collection A/c celled for renewal)

or

To Endorsee’s A/c

(Being old bill cancelled for

renewal)

2 Interest paid in cash along Cash / Bank A/c Dr. Drawee’s A/c Dr.

with part payment To Drawee’s A/c Interest A/c Dr.

To Interest A/c To Cash / Bank A/c

(Being part payment received (Being part payment made

along with interest) along with Interest)

3 New bill drawn for the bal- Bill Receivable A/c Dr. Drawer’s A/c Dr.

ance and acceptance re- To Drawee’s A/c To Bill payable A/c

ceived (Being new bill drawn and (Being acceptance given)

acceptance received)

Retirement of Bill under Rebate :

Making payment of bill well before the date of maturity is known as retirement of bill. When the

acceptor of bill makes payment to the holder before the due date it is known as retiring a bill. Drawer

allows some Discount or Rebate to the Drawee for the unexpired period. This rebate in an expense

to the Drawer or Holder and income to the Drawee or Acceptor.

Accounting Treatment in the Books of Drawer and Drawee :

Books of Drawer Books of Drawee

Cash / Bank A/c Dr. Bills Payable A/c Dr.

Rebate / Discount A/c Dr. To Cash / Bank A/c

To Bills Receivable A/c To Rebate / Discount A/c

(Being bill retired and rebate allowed) (Being our acceptance retired and rebate

received)

Insolvency of Drawee :

Person whose liabilities are more than the assets and is not in a position to pay off his liabilities is

known as insolvent person. When the Acceptor or Drawee is declared insolvent by the court, bills

278