Page 283 - VIRANSH COACHING CLASSES

P. 283

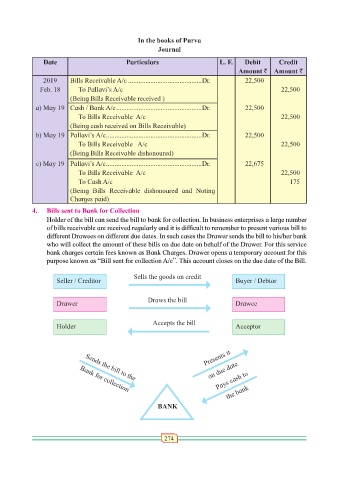

In the books of Purva

Journal

Date Particulars L. F. Debit Credit

Amount ` Amount `

2019 Bills Receivable A/c ...........................................Dr. 22,500

Feb. 18 To Pallavi’s A/c 22,500

(Being Bills Receivable received )

a) May 19 Cash / Bank A/c ..................................................Dr. 22,500

To Bills Receivable A/c 22,500

(Being cash received on Bills Receivable)

b) May 19 Pallavi’s A/c ........................................................Dr. 22,500

To Bills Receivable A/c 22,500

(Being Bills Receivable dishonoured)

c) May 19 Pallavi’s A/c ........................................................Dr. 22,675

To Bills Receivable A/c 22,500

To Cash A/c 175

(Being Bills Receivable dishonoured and Noting

Charges paid)

4. Bills sent to Bank for Collection

Holder of the bill can send the bill to bank for collection. In business enterprises a large number

of bills receivable are received regularly and it is difficult to remember to present various bill to

different Drawees on different due dates. In such cases the Drawer sends the bill to his/her bank

who will collect the amount of these bills on due date on behalf of the Drawer. For this service

bank charges certain fees known as Bank Charges. Drawer opens a temporary account for this

purpose known as “Bill sent for collection A/c”. This account closes on the due date of the Bill.

Sells the goods on credit

Seller / Creditor Buyer / Debtor

Draws the bill

Drawer Drawee

Accepts the bill

Holder Acceptor

Presents it

on due date

Pays cash to

Sends the bill to the

the bank

Bank for collection

BANK

274