Page 295 - VIRANSH COACHING CLASSES

P. 295

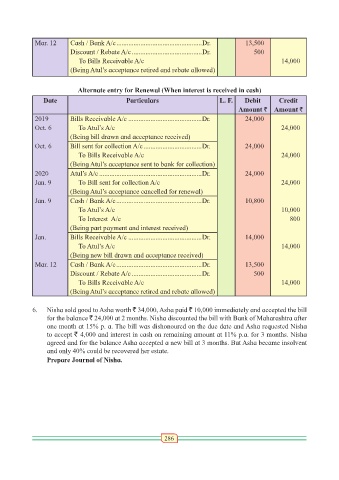

Mar. 12 Cash / Bank A/c ..................................................Dr. 13,500

Discount / Rebate A/c .........................................Dr. 500

To Bills Receivable A/c 14,000

(Being Atul’s acceptance retired and rebate allowed)

Alternate entry for Renewal (When interest is received in cash)

Date Particulars L. F. Debit Credit

Amount ` Amount `

2019 Bills Receivable A/c ...........................................Dr. 24,000

Oct. 6 To Atul’s A/c 24,000

(Being bill drawn and acceptance received)

Oct. 6 Bill sent for collection A/c ..................................Dr. 24,000

To Bills Receivable A/c 24,000

(Being Atul’s acceptance sent to bank for collection)

2020 Atul’s A/c ............................................................Dr. 24,000

Jan. 9 To Bill sent for collection A/c 24,000

(Being Atul’s acceptance cancelled for renewal)

Jan. 9 Cash / Bank A/c ..................................................Dr. 10,800

To Atul’s A/c 10,000

To Interest A/c 800

(Being part payment and interest received)

Jan. Bills Receivable A/c ...........................................Dr. 14,000

To Atul’s A/c 14,000

(Being new bill drawn and acceptance received)

Mar. 12 Cash / Bank A/c ..................................................Dr. 13,500

Discount / Rebate A/c .........................................Dr. 500

To Bills Receivable A/c 14,000

(Being Atul’s acceptance retired and rebate allowed)

6. Nisha sold good to Asha worth ` 34,000, Asha paid ` 10,000 immediately and accepted the bill

for the balance ` 24,000 at 2 months. Nisha discounted the bill with Bank of Maharashtra after

one month at 15% p. a. The bill was dishonoured on the due date and Asha requested Nisha

to accept ` 4,000 and interest in cash on remaining amount at 11% p.a. for 3 months. Nisha

agreed and for the balance Asha accepted a new bill at 3 months. But Asha became insolvent

and only 40% could be recovered her estate.

Prepare Journal of Nisha.

286