Page 296 - VIRANSH COACHING CLASSES

P. 296

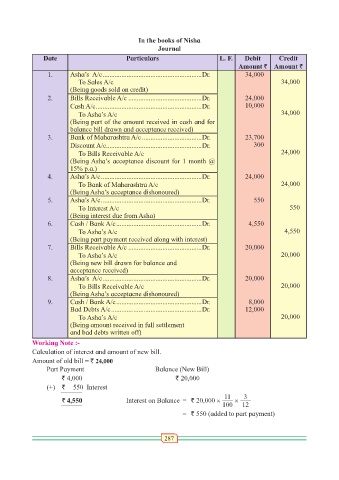

In the books of Nisha

Journal

Date Particulars L. F. Debit Credit

Amount ` Amount `

1. Asha’s A/c ..........................................................Dr. 34,000

To Sales A/c 34,000

(Being goods sold on credit)

2. Bills Receivable A/c ...........................................Dr. 24,000

Cash A/c ..............................................................Dr. 10,000

To Asha’s A/c 34,000

(Being part of the amount received in cash and for

balance bill drawn and acceptance received)

3. Bank of Maharashtra A/c ...................................Dr. 23,700

Discount A/c ........................................................Dr. 300

To Bills Receivable A/c 24,000

(Being Asha’s acceptance discount for 1 month @

15% p.a.)

4. Asha’s A/c ...........................................................Dr. 24,000

To Bank of Maharashtra A/c 24,000

(Being Asha’s acceptance dishonoured)

5. Asha’s A/c ...........................................................Dr. 550

To Interest A/c 550

(Being interest due from Asha)

6. Cash / Bank A/c ..................................................Dr. 4,550

To Asha’s A/c 4,550

(Being part payment received along with interest)

7. Bills Receivable A/c ...........................................Dr. 20,000

To Asha’s A/c 20,000

(Being new bill drawn for balance and

acceptance received)

8. Asha’s A/c ..........................................................Dr. 20,000

To Bills Receivable A/c 20,000

(Being Asha’s acceptacne dishonoured)

9. Cash / Bank A/c ..................................................Dr. 8,000

Bad Debts A/c .....................................................Dr. 12,000

To Asha’s A/c 20,000

(Being amount received in full settlement

and bad debts written off)

Working Note :-

Calculation of interest and amount of new bill.

Amount of old bill = ` 24,000

Part Payment Balance (New Bill)

` 4,000 ` 20,000

(+) ` 550 Interest

11 3

` 4,550 Interest on Balance = ` 20,000 × ×

100 12

= ` 550 (added to part payment)

287