Page 13 - LGB Group

P. 13

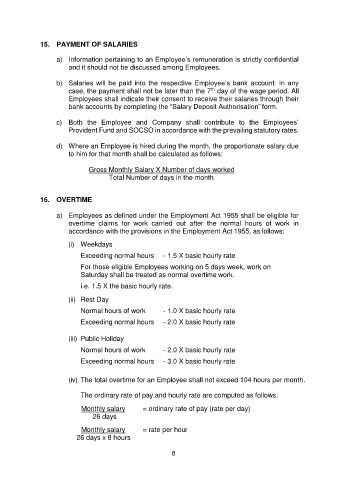

15. PAYMENT OF SALARIES

a) Information pertaining to an Employee’s remuneration is strictly confidential

and it should not be discussed among Employees.

b) Salaries will be paid into the respective Employee’s bank account. In any

th

case, the payment shall not be later than the 7 day of the wage period. All

Employees shall indicate their consent to receive their salaries through their

bank accounts by completing the “Salary Deposit Authorisation” form.

c) Both the Employee and Company shall contribute to the Employees’

Provident Fund and SOCSO in accordance with the prevailing statutory rates.

d) Where an Employee is hired during the month, the proportionate salary due

to him for that month shall be calculated as follows:

Gross Monthly Salary X Number of days worked

Total Number of days in the month

16. OVERTIME

a) Employees as defined under the Employment Act 1955 shall be eligible for

overtime claims for work carried out after the normal hours of work in

accordance with the provisions in the Employment Act 1955, as follows:

(i) Weekdays

Exceeding normal hours - 1.5 X basic hourly rate

For those eligible Employees working on 5 days week, work on

Saturday shall be treated as normal overtime work.

i.e. 1.5 X the basic hourly rate.

(ii) Rest Day

Normal hours of work - 1.0 X basic hourly rate

Exceeding normal hours - 2.0 X basic hourly rate

(iii) Public Holiday

Normal hours of work - 2.0 X basic hourly rate

Exceeding normal hours - 3.0 X basic hourly rate

(iv) The total overtime for an Employee shall not exceed 104 hours per month.

The ordinary rate of pay and hourly rate are computed as follows:

Monthly salary = ordinary rate of pay (rate per day)

26 days

Monthly salary = rate per hour

26 days x 8 hours

8