Page 125 - ACFE Fraud Reports 2009_2020

P. 125

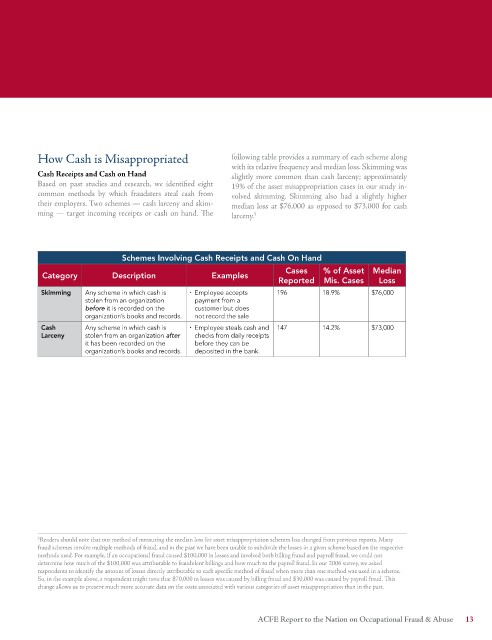

How Cash is Misappropriated following table provides a summary of each scheme along

with its relative frequency and median loss. Skimming was

Cash Receipts and Cash on Hand slightly more common than cash larceny; approximately

Based on past studies and research, we identified eight 19% of the asset misappropriation cases in our study in-

common methods by which fraudsters steal cash from volved skimming. Skimming also had a slightly higher

their employers. Two schemes — cash larceny and skim- median loss at $76,000 as opposed to $73,000 for cash

ming — target incoming receipts or cash on hand. The larceny. 5

Schemes Involving Cash Receipts and Cash On Hand

Cases % of Asset Median

Category Description Examples

Reported Mis. Cases Loss

Skimming Any scheme in which cash is ¨ employee accepts 196 18.9% $76,000

stolen from an organization payment from a

before it is recorded on the customer but does

organization’s books and records. not record the sale

Cash Any scheme in which cash is ¨ employee steals cash and 147 14.2% $73,000

Larceny stolen from an organization after checks from daily receipts

it has been recorded on the before they can be

organization’s books and records. deposited in the bank.

5 Readers should note that our method of measuring the median loss for asset misappropriation schemes has changed from previous reports. Many

fraud schemes involve multiple methods of fraud, and in the past we have been unable to subdivide the losses in a given scheme based on the respective

methods used. For example, if an occupational fraud caused $100,000 in losses and involved both billing fraud and payroll fraud, we could not

determine how much of the $100,000 was attributable to fraudulent billings and how much to the payroll fraud. In our 2006 survey, we asked

respondents to identify the amount of losses directly attributable to each specific method of fraud when more than one method was used in a scheme.

So, in the example above, a respondent might note that $70,000 in losses was caused by billing fraud and $30,000 was caused by payroll fraud. This

change allows us to present much more accurate data on the costs associated with various categories of asset misappropriation than in the past.

ACFE Report to the Nation on Occupational Fraud & Abuse 1