Page 126 - ACFE Fraud Reports 2009_2020

P. 126

How Occupational Fraud is Committed

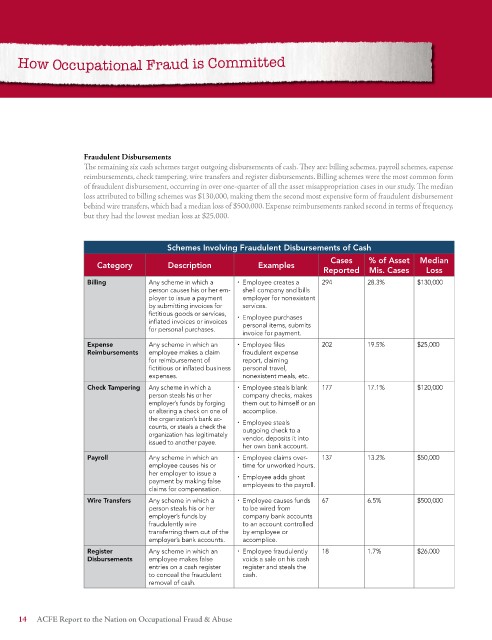

Fraudulent Disbursements

The remaining six cash schemes target outgoing disbursements of cash. They are: billing schemes, payroll schemes, expense

reimbursements, check tampering, wire transfers and register disbursements. Billing schemes were the most common form

of fraudulent disbursement, occurring in over one-quarter of all the asset misappropriation cases in our study. The median

loss attributed to billing schemes was $130,000, making them the second most expensive form of fraudulent disbursement

behind wire transfers, which had a median loss of $500,000. Expense reimbursements ranked second in terms of frequency,

but they had the lowest median loss at $25,000.

Schemes Involving Fraudulent Disbursements of Cash

Cases % of Asset Median

Category Description Examples

Reported Mis. Cases Loss

Billing Any scheme in which a ¨ employee creates a 294 28.3% $130,000

person causes his or her em- shell company and bills

ployer to issue a payment employer for nonexistent

by submitting invoices for services.

fictitious goods or services, ¨ employee purchases

inflated invoices or invoices personal items, submits

for personal purchases.

invoice for payment.

Expense Any scheme in which an ¨ employee files 202 19.5% $25,000

Reimbursements employee makes a claim fraudulent expense

for reimbursement of report, claiming

fictitious or inflated business personal travel,

expenses. nonexistent meals, etc.

Check Tampering Any scheme in which a ¨ employee steals blank 177 17.1% $120,000

person steals his or her company checks, makes

employer’s funds by forging them out to himself or an

or altering a check on one of accomplice.

the organization’s bank ac- employee steals

counts, or steals a check the ¨ outgoing check to a

organization has legitimately vendor, deposits it into

issued to another payee.

her own bank account.

Payroll Any scheme in which an ¨ employee claims over- 137 13.2% $50,000

employee causes his or time for unworked hours.

her employer to issue a ¨ employee adds ghost

payment by making false employees to the payroll.

claims for compensation.

Wire Transfers Any scheme in which a ¨ employee causes funds 67 6.5% $500,000

person steals his or her to be wired from

employer’s funds by company bank accounts

fraudulently wire to an account controlled

transferring them out of the by employee or

employer’s bank accounts. accomplice.

Register Any scheme in which an ¨ employee fraudulently 18 1.7% $26,000

Disbursements employee makes false voids a sale on his cash

entries on a cash register register and steals the

to conceal the fraudulent cash.

removal of cash.

1 ACFE Report to the Nation on Occupational Fraud & Abuse