Page 160 - ACFE Fraud Reports 2009_2020

P. 160

The Perpetrators

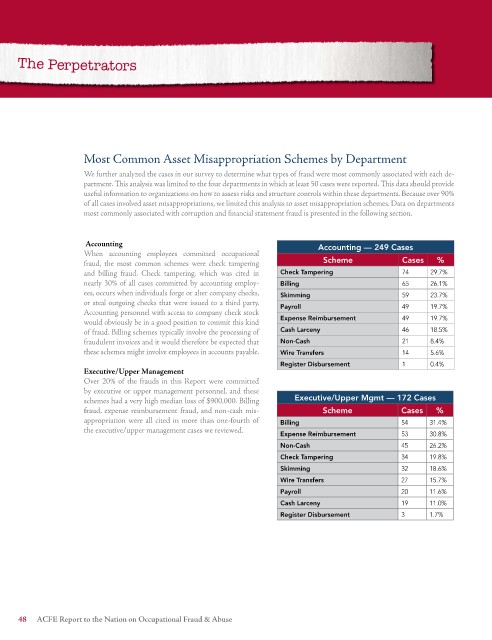

Most Common Asset Misappropriation Schemes by Department

We further analyzed the cases in our survey to determine what types of fraud were most commonly associated with each de-

partment. This analysis was limited to the four departments in which at least 50 cases were reported. This data should provide

useful information to organizations on how to assess risks and structure controls within these departments. Because over 90%

of all cases involved asset misappropriations, we limited this analysis to asset misappropriation schemes. Data on departments

most commonly associated with corruption and financial statement fraud is presented in the following section.

Accounting Accounting — 249 Cases

When accounting employees committed occupational

fraud, the most common schemes were check tampering Scheme Cases %

and billing fraud. Check tampering, which was cited in Check Tampering 74 29.7%

nearly 30% of all cases committed by accounting employ- Billing 65 26.1%

ees, occurs when individuals forge or alter company checks, Skimming 59 23.7%

or steal outgoing checks that were issued to a third party. Payroll 49 19.7%

Accounting personnel with access to company check stock

would obviously be in a good position to commit this kind Expense Reimbursement 49 19.7%

of fraud. Billing schemes typically involve the processing of Cash Larceny 46 18.5%

fraudulent invoices and it would therefore be expected that Non-Cash 21 8.4%

these schemes might involve employees in accounts payable. Wire Transfers 14 5.6%

Register Disbursement 1 0.4%

Executive/Upper Management

Over 20% of the frauds in this Report were committed

by executive or upper management personnel, and these

schemes had a very high median loss of $900,000. Billing Executive/Upper Mgmt — 172 Cases

fraud, expense reimbursement fraud, and non-cash mis- Scheme Cases %

appropriation were all cited in more than one-fourth of Billing 54 31.4%

the executive/upper management cases we reviewed.

Expense Reimbursement 53 30.8%

Non-Cash 45 26.2%

Check Tampering 34 19.8%

Skimming 32 18.6%

Wire Transfers 27 15.7%

Payroll 20 11.6%

Cash Larceny 19 11.0%

Register Disbursement 3 1.7%

ACFE Report to the Nation on Occupational Fraud & Abuse