Page 289 - ACFE Fraud Reports 2009_2020

P. 289

Control Weaknesses that Contributed to Fraud

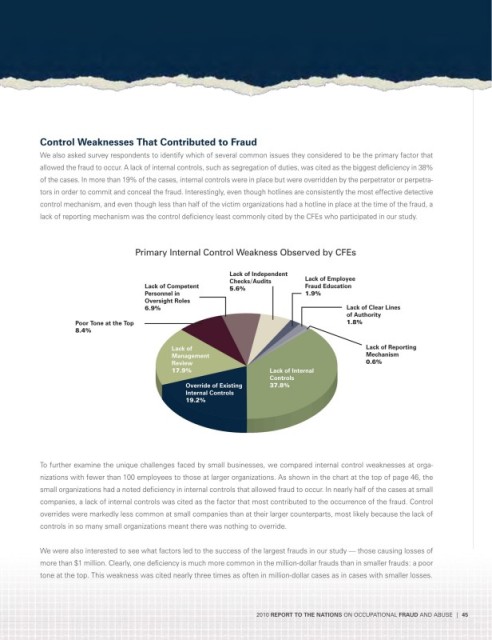

We also asked survey respondents to identify which of several common issues they considered to be the primary factor that

allowed the fraud to occur. A lack of internal controls, such as segregation of duties, was cited as the biggest deficiency in 38%

of the cases. In more than 19% of the cases, internal controls were in place but were overridden by the perpetrator or perpetra-

tors in order to commit and conceal the fraud. Interestingly, even though hotlines are consistently the most effective detective

control mechanism, and even though less than half of the victim organizations had a hotline in place at the time of the fraud, a

lack of reporting mechanism was the control deficiency least commonly cited by the CFEs who participated in our study.

Primary Internal control Weakness Observed by cFEs

Lack of Independent

Checks/Audits Lack of Employee

Lack of Competent 5.6% Fraud Education

Personnel in 1.9%

Oversight Roles

6.9% Lack of Clear Lines

of Authority

Poor Tone at the Top 1.8%

8.4%

Lack of Lack of Reporting

Management Mechanism

Review 0.6%

17.9% Lack of Internal

Controls

Override of Existing 37.8%

Internal Controls

19.2%

To further examine the unique challenges faced by small businesses, we compared internal control weaknesses at orga-

nizations with fewer than 100 employees to those at larger organizations. As shown in the chart at the top of page 46, the

small organizations had a noted deficiency in internal controls that allowed fraud to occur. In nearly half of the cases at small

companies, a lack of internal controls was cited as the factor that most contributed to the occurrence of the fraud. Control

overrides were markedly less common at small companies than at their larger counterparts, most likely because the lack of

controls in so many small organizations meant there was nothing to override.

We were also interested to see what factors led to the success of the largest frauds in our study — those causing losses of

more than $1 million. Clearly, one deficiency is much more common in the million-dollar frauds than in smaller frauds: a poor

tone at the top. This weakness was cited nearly three times as often in million-dollar cases as in cases with smaller losses.

2010 RepoRt to the NAtioNs ON OccuPATIONAl FRAUD ANd AbuSE | 45