Page 355 - ACFE Fraud Reports 2009_2020

P. 355

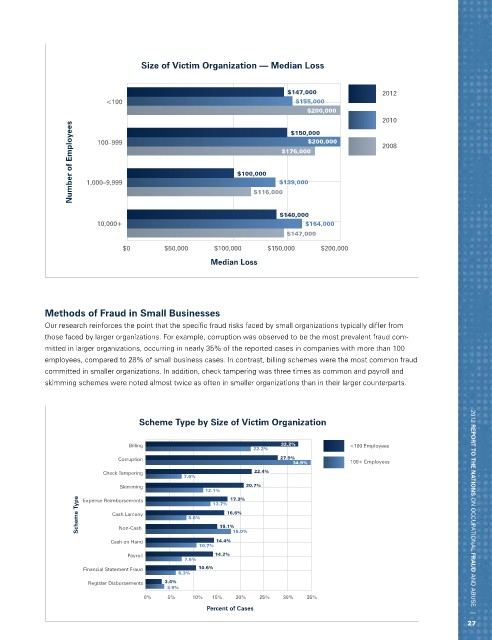

Size of Victim Organization — Median Loss

$147,000 2012

<100 $155,000

$200,000

2010

Number of Employees 1,000–9,999 $100,000 $139,000 $200,000 2008

$150,000

100–999

$176,000

$116,000

$140,000

10,000+ $164,000

$147,000

$0 $50,000 $100,000 $150,000 $200,000

Median Loss

Methods of Fraud in Small Businesses

Our research reinforces the point that the specific fraud risks faced by small organizations typically differ from

those faced by larger organizations. For example, corruption was observed to be the most prevalent fraud com-

mitted in larger organizations, occurring in nearly 35% of the reported cases in companies with more than 100

employees, compared to 28% of small business cases. In contrast, billing schemes were the most common fraud

committed in smaller organizations. In addition, check tampering was three times as common and payroll and

skimming schemes were noted almost twice as often in smaller organizations than in their larger counterparts.

Scheme Type by Size of Victim Organization

Billing 32.2% <100 Employees

22.2%

Corruption 27.9%

34.9% 100+ Employees

Check Tampering 22.4%

7.6%

Skimming 20.7%

12.1% 17.3%

Scheme Type Cash Larceny 8.6% 13.7% 16.6% 2012 REPORT TO THE NATIONS on occupational FRAUD and abuse |

Expense Reimbursements

15.1%

Non-Cash

Cash on Hand 14.4% 18.0%

10.7%

Payroll 14.2%

7.6%

Financial Statement Fraud 10.6%

6.3%

Register Disbursements 3.4%

3.9%

0% 5% 10% 15% 20% 25% 30% 35%

Percent of Cases

27