Page 527 - ACFE Fraud Reports 2009_2020

P. 527

Victim Organizations

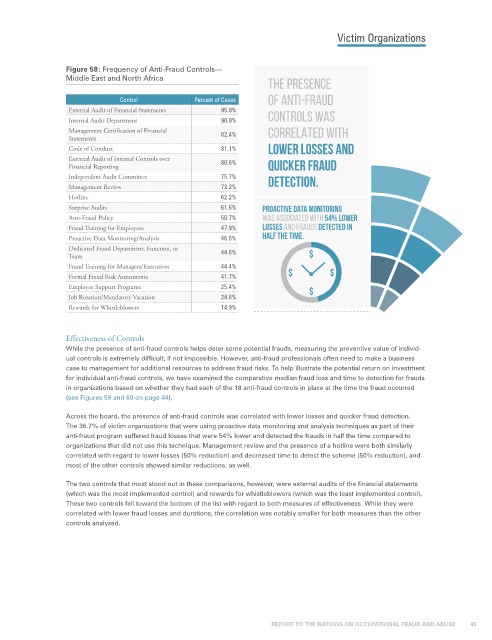

Figure 58: Frequency of Anti-Fraud Controls—

Middle East and North Africa

THE PRESENCE

Control Percent of Cases OF ANTI-FRAUD

External Audit of Financial Statements 95.9%

Internal Audit Department 90.9% CONTROLS WAS

Management Certification of Financial 82.4% CORRELATED WITH

Statements

Code of Conduct 81.1% LOWER LOSSES AND

External Audit of Internal Controls over 80.6%

Financial Reporting QUICKER FRAUD

Independent Audit Committee 75.7% DETECTION.

Management Review 73.2%

Hotline 62.2%

Surprise Audits 61.6% PROACTIVE DATA MONITORING

Anti-Fraud Policy 50.7% was associated with 54% lower

Fraud Training for Employees 47.9% losses and frauds detected in

Proactive Data Monitoring/Analysis 46.5% half the time.

Dedicated Fraud Department, Function, or 44.6%

$

Team 46 + 54+ Q

Fraud Training for Managers/Executives 44.4%

Formal Fraud Risk Assessments 41.7% $ $

Employee Support Programs 25.4% $

Job Rotation/Mandatory Vacation 24.6%

Rewards for Whistleblowers 14.9%

Effectiveness of Controls

While the presence of anti-fraud controls helps deter some potential frauds, measuring the preventive value of individ-

ual controls is extremely difficult, if not impossible. However, anti-fraud professionals often need to make a business

case to management for additional resources to address fraud risks. To help illustrate the potential return on investment

for individual anti-fraud controls, we have examined the comparative median fraud loss and time to detection for frauds

in organizations based on whether they had each of the 18 anti-fraud controls in place at the time the fraud occurred

(see Figures 59 and 60 on page 44).

Across the board, the presence of anti-fraud controls was correlated with lower losses and quicker fraud detection.

The 36.7% of victim organizations that were using proactive data monitoring and analysis techniques as part of their

anti-fraud program suffered fraud losses that were 54% lower and detected the frauds in half the time compared to

organizations that did not use this technique. Management review and the presence of a hotline were both similarly

correlated with regard to lower losses (50% reduction) and decreased time to detect the scheme (50% reduction), and

most of the other controls showed similar reductions, as well.

The two controls that most stood out in these comparisons, however, were external audits of the financial statements

(which was the most implemented control) and rewards for whistleblowers (which was the least implemented control).

These two controls fell toward the bottom of the list with regard to both measures of effectiveness. While they were

correlated with lower fraud losses and durations, the correlation was notably smaller for both measures than the other

controls analyzed.

REPORT TO THE NATIONS ON OCCUPATIONAL FRAUD AND ABUSE 43