Page 522 - ACFE Fraud Reports 2009_2020

P. 522

Victim Organizations

Anti-Fraud Controls at the Victim Organization

While the presence of internal controls does not provide guaranteed protection against fraud, it can help to both

mitigate losses and deter some potential fraudsters by enhancing the perception of detection. Consequently, enacting

internal controls specifically designed to prevent and detect fraud is a vital part of a fraud risk management program.

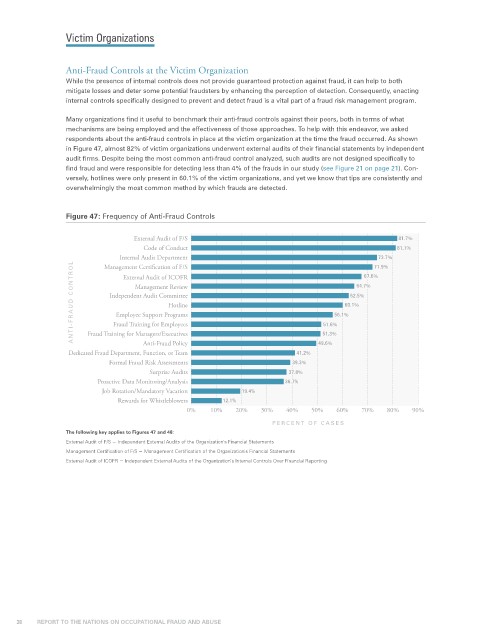

Many organizations find it useful to benchmark their anti-fraud controls against their peers, both in terms of what

mechanisms are being employed and the effectiveness of those approaches. To help with this endeavor, we asked

respondents about the anti-fraud controls in place at the victim organization at the time the fraud occurred. As shown

in Figure 47, almost 82% of victim organizations underwent external audits of their financial statements by independent

audit firms. Despite being the most common anti-fraud control analyzed, such audits are not designed specifically to

find fraud and were responsible for detecting less than 4% of the frauds in our study (see Figure 21 on page 21). Con-

versely, hotlines were only present in 60.1% of the victim organizations, and yet we know that tips are consistently and

overwhelmingly the most common method by which frauds are detected.

Figure 47: Frequency of Anti-Fraud Controls

External Audit of F/S 81.7%

Code of Conduct 81.1%

Internal Audit Department 67.6% 71.9%

73.7%

ANTI-FRA UD CONTROL Independent Audit Committee 51.6% 56.1% 60.1% 64.7%

Management Certification of F/S

External Audit of ICOFR

Management Review

62.5%

Hotline

Employee Support Programs

Fraud Training for Employees

Fraud Training for Managers/Executives

51.3%

Anti-Fraud Policy

Dedicated Fraud Department, Function, or Team 41.2% 49.6%

Formal Fraud Risk Assessments 39.3%

Surprise Audits 37.8%

Proactive Data Monitoring/Analysis 36.7%

Job Rotation/Mandatory Vacation 19.4%

Rewards for Whistleblowers 12.1%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

PERCENT OF CASES

The following key applies to Figures 47 and 48:

External Audit of F/S = Independent External Audits of the Organization’s Financial Statements

Management Certification of F/S = Management Certification of the Organization’s Financial Statements

External Audit of ICOFR = Independent External Audits of the Organization’s Internal Controls Over Financial Reporting

38 REPORT TO THE NATIONS ON OCCUPATIONAL FRAUD AND ABUSE