Page 531 - ACFE Fraud Reports 2009_2020

P. 531

Victim Organizations

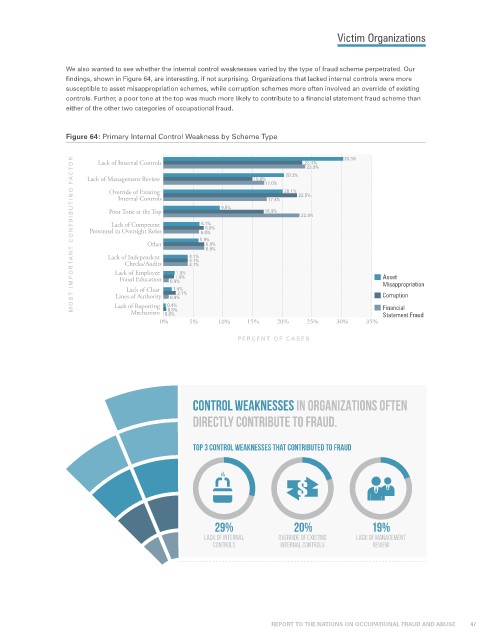

We also wanted to see whether the internal control weaknesses varied by the type of fraud scheme perpetrated. Our

findings, shown in Figure 64, are interesting, if not surprising. Organizations that lacked internal controls were more

susceptible to asset misappropriation schemes, while corruption schemes more often involved an override of existing

controls. Further, a poor tone at the top was much more likely to contribute to a financial statement fraud scheme than

either of the other two categories of occupational fraud.

Figure 64: Primary Internal Control Weakness by Scheme Type

30.3%

MOST IMPORTANT CONTRIBUTING FA CTOR

Lack of Internal Controls 23.4%

23.9%

20.3%

Lack of Management Review 15.0%

17.0%

Override of Existing 20.1% 22.5%

Internal Controls 17.4%

9.5%

Poor Tone at the Top 16.9%

22.9%

Lack of Competent 6.1%

6.8%

Personnel in Oversight Roles 6.0%

5.9%

Other 6.9%

6.9%

Lack of Independent 4.1%

4.1%

Checks/Audits 4.1%

Lack of Employee 1.9%

1.8%

Fraud Education 0.9% Asset

Misappropriation

Lack of Clear 1.4%

Lines of Authority 0.9% 2.1% Corruption

Lack of Reporting 0.4% Financial

0.5%

Mechanism 0.0% Statement Fraud

0% 5% 10% 15% 20% 25% 30% 35%

PERCENT OF CASES

CONTROL WEAKNESSES IN ORGANIZATIONS OFTEN

DIRECTLY CONTRIBUTE TO FRAUD.

Q

80+

+

+

71+

292019 + Q 81+

Q

top 3 control weaknesses that contributed to fraud

29% 20% 19%

LACK OF INTERNAL override of existing lack of management

CONTROLS internal controls review

REPORT TO THE NATIONS ON OCCUPATIONAL FRAUD AND ABUSE 47