Page 588 - ACFE Fraud Reports 2009_2020

P. 588

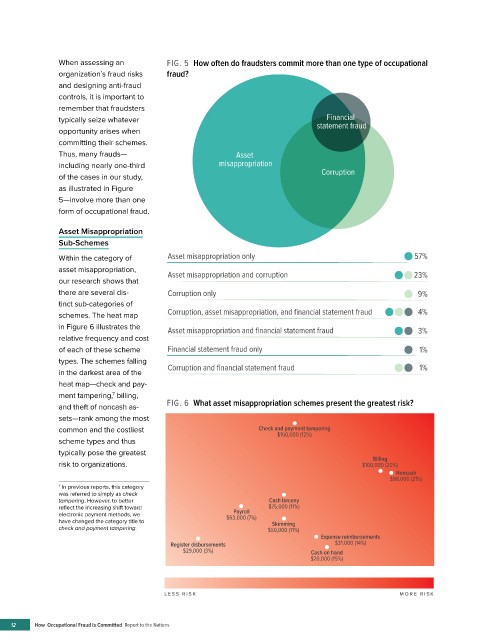

When assessing an FIG. 5 How often do fraudsters commit more than one type of occupational

organization’s fraud risks fraud?

and designing anti-fraud

controls, it is important to

remember that fraudsters

Financial

typically seize whatever statement fraud

opportunity arises when

committing their schemes.

Thus, many frauds— Asset

including nearly one-third misappropriation

of the cases in our study, Corruption

as illustrated in Figure

5—involve more than one

form of occupational fraud.

Asset Misappropriation

Sub-Schemes

Within the category of Asset misappropriation only 57%

asset misappropriation, Asset misappropriation and corruption 23%

our research shows that

there are several dis- Corruption only 9%

tinct sub-categories of

schemes. The heat map Corruption, asset misappropriation, and financial statement fraud 4%

in Figure 6 illustrates the Asset misappropriation and financial statement fraud 3%

relative frequency and cost

of each of these scheme Financial statement fraud only 1%

types. The schemes falling

in the darkest area of the Corruption and financial statement fraud 1%

heat map—check and pay-

7

ment tampering, billing,

and theft of noncash as- FIG. 6 What asset misappropriation schemes present the greatest risk?

sets—rank among the most

common and the costliest Check and payment tampering

$150,000 (12%)

scheme types and thus

typically pose the greatest

Billing

risk to organizations. $100,000 (20%)

Noncash

$98,000 (21%)

7 In previous reports, this category

was referred to simply as check

tampering. However, to better Cash larceny

reflect the increasing shift toward $75,000 (11%)

Payroll

electronic payment methods, we $63,000 (7%)

have changed the category title to Skimming

check and payment tampering. $50,000 (11%)

Expense reimbursements

Register disbursements $31,000 (14%)

$29,000 (3%) Cash on hand

$20,000 (15%)

LESS RISK MORE RISK

12 How Occupational Fraud Is Committed Report to the Nations