Page 591 - ACFE Fraud Reports 2009_2020

P. 591

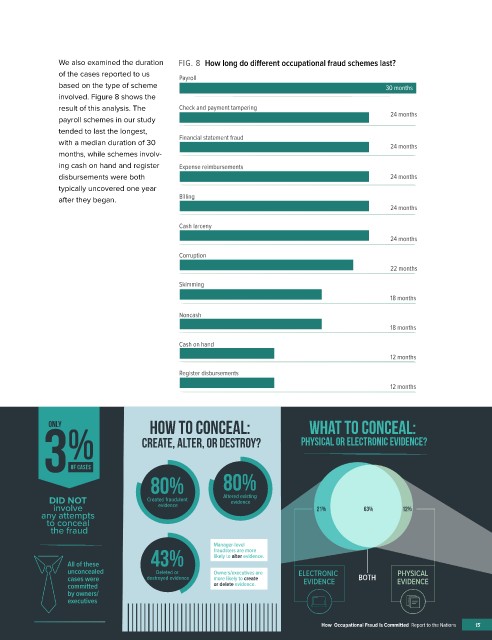

We also examined the duration FIG. 8 How long do different occupational fraud schemes last?

of the cases reported to us Payroll

based on the type of scheme 30 months

involved. Figure 8 shows the

result of this analysis. The Check and payment tampering

payroll schemes in our study 24 months

tended to last the longest,

with a median duration of 30 Financial statement fraud 24 months

months, while schemes involv-

ing cash on hand and register Expense reimbursements

disbursements were both 24 months

typically uncovered one year

after they began. Billing

24 months

Cash larceny

24 months

Corruption

22 months

Skimming

18 months

Noncash

18 months

Cash on hand

12 months

Register disbursements

12 months

How to Conceal:

what to Conceal:

3

CONCEALING FRAUD ONLY % Create, Alter, or Destroy? physical or electronic evidence?

�

�

�

�

80%

An act of fraud typically involves not only the commission of the scheme itself, but also e orts OF CASES �� � � � �

80%

to conceal the misdeeds. Understanding the methods fraudsters use to cover their crimes can

help organizations better design prevention mechanisms and detect the warning signs of fraud. DID NOT Created fraudulent Altered existing

evidence

evidence

involve

any attempts 21% 63% 12%

TOP 8 CONCEALMENT METHODS USED BY FRAUDSTERS to conceal Manager-level

the fraud

43%

likely to alter evidence.

All of these � � � � � fraudsters are more

unconcealed Deleted or Owners/executives are ELECTRONIC PHYSICAL

55% 48% 42% 34% 31% 30% 29% 27% cases were destroyed evidence more likely to create EVIDENCE BOTH EVIDENCE

or delete evidence.

committed

Created fraudulent Altered physical Created fraudulent Altered transactions Altered electronic Destroyed physical Created fraudulent Created fraudulent by owners/

physical documents documents transactions in the in the accounting documents or files documents electronic journal entries executives

accounting system system documents or files

How Occupational Fraud Is Committed Report to the Nations 15