Page 60 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 60

(iii) Market risk

Market risk is the risk of loss of income arising from unfavourable market movements, including foreign exchange

rates and profit rates. The objective of market risk management is to manage and control exposures within

acceptable parameters, whilst optimising returns. The Company is not exposed to any material foreign currency

risk. Given the bank’s current profile of financial instruments, the principal exposure is the risk of loss arising from

fluctuations in the future cash flows or fair values of these financial instruments because of a change in achievable

rates. This is managed principally through monitoring gaps between effective profit and rental rates and reviewing

approved rates and bands at regular re-pricing meetings:

Profit rates for Commodity Murabaha receivables are agreed with the counterparty bank at the time of

each transaction and the profit (mark-up) and effective yield rate is consequently fixed (for Murabaha) for

the duration of the contract. Risk exposure is managed by reviewing the maturity profiles of transactions

entered into.

Effective rates applied to new consumer finance transactions are agreed on a monthly basis by ALCO

and the profit (mark-up) will then be fixed for each individual transaction for the agreed deferred payment

term.

Profit rates payable on Mudaraba customer deposit accounts are calculated at each month-end in line

with the profit allocation model and the customer terms and conditions. Profit rates payable on Murabaha

deposits are agreed with the customer at the time of each transaction and the profit (mark-up) and effective

yield rate is consequently fixed (for Murabaha) and maintained (for Wakala) for the duration of the contract.

Risk exposure is managed by reviewing the maturity profiles of transactions entered into.

Management of market risk

Overall authority for market risk is vested in ALCO. Risk Management Committee is responsible for the

development of detailed risk management policies (subject to review and approval by the board) and for the day-

to-day review of their implementation.

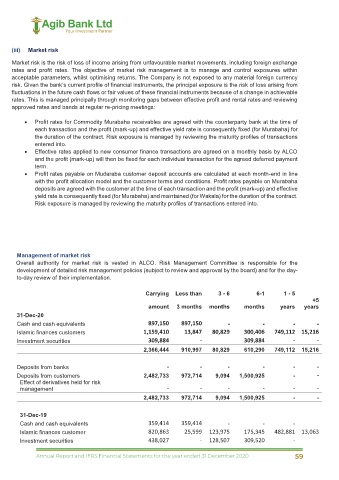

Carrying Less than 3 - 6 6-1 1 - 5

+5

amount 3 months months months years years

31-Dec-20

Cash and cash equivalents 897,150 897,150 - - - -

Islamic finances customers 1,159,410 13,847 80,829 300,406 749,112 15,216

Investment securities 309,884 - 309,884 - -

2,366,444 910,997 80,829 610,290 749,112 15,216

Deposits from banks - - - - - -

Deposits from customers 2,482,733 972,714 9,094 1,500,925 - -

Effect of derivatives held for risk

management - - - - - -

2,482,733 972,714 9,094 1,500,925 - -

31-Dec-19

Cash and cash equivalents 359,414 359,414 - - -

Islamic finances customer 820,863 25,599 123,975 175,345 482,881 13,063

Investment securities 438,027 - 128,507 309,520 -

44

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 59