Page 62 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 62

The bank is currently holding 558,000 shares in Trust Bank (G) Limited valued at D2.193 million. These shares

were given to the bank by the courts as part settlement of an overdue debt. Annual dividend received does not

form part of the bank’s annual revenue but is rather given out as charity as recommended by the Sharia Board.

We are negotiating with potential buyers to sell it off. Dividend of D0.26 million was received in 2020.

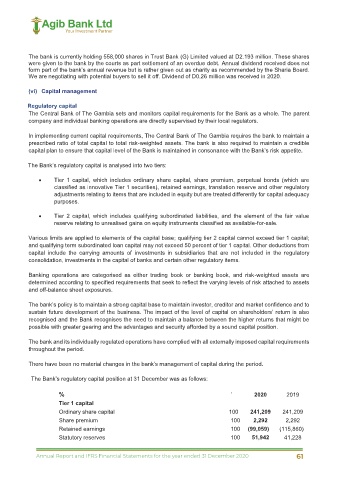

(vi) Capital management

Regulatory capital

The Central Bank of The Gambia sets and monitors capital requirements for the Bank as a whole. The parent

company and individual banking operations are directly supervised by their local regulators.

In implementing current capital requirements, The Central Bank of The Gambia requires the bank to maintain a

prescribed ratio of total capital to total risk-weighted assets. The bank is also required to maintain a credible

capital plan to ensure that capital level of the Bank is maintained in consonance with the Bank’s risk appetite.

The Bank’s regulatory capital is analysed into two tiers:

Tier 1 capital, which includes ordinary share capital, share premium, perpetual bonds (which are

classified as innovative Tier 1 securities), retained earnings, translation reserve and other regulatory

adjustments relating to items that are included in equity but are treated differently for capital adequacy

purposes.

Tier 2 capital, which includes qualifying subordinated liabilities, and the element of the fair value

reserve relating to unrealised gains on equity instruments classified as available-for-sale.

Various limits are applied to elements of the capital base; qualifying tier 2 capital cannot exceed tier 1 capital;

and qualifying term subordinated loan capital may not exceed 50 percent of tier 1 capital. Other deductions from

capital include the carrying amounts of investments in subsidiaries that are not included in the regulatory

consolidation, investments in the capital of banks and certain other regulatory items.

Banking operations are categorised as either trading book or banking book, and risk-weighted assets are

determined according to specified requirements that seek to reflect the varying levels of risk attached to assets

and off-balance sheet exposures.

The bank’s policy is to maintain a strong capital base to maintain investor, creditor and market confidence and to

sustain future development of the business. The impact of the level of capital on shareholders’ return is also

recognised and the Bank recognises the need to maintain a balance between the higher returns that might be

possible with greater gearing and the advantages and security afforded by a sound capital position.

The bank and its individually regulated operations have complied with all externally imposed capital requirements

throughout the period.

There have been no material changes in the bank’s management of capital during the period.

The Bank’s regulatory capital position at 31 December was as follows:

% ` 2020 2019

Tier 1 capital

Ordinary share capital 100 241,209 241,209

Share premium 100 2,292 2,292

Retained earnings 100 (99,059) (115,860)

Statutory reserves 100 51,942 41,228

46

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 61