Page 33 - AYZ.indd

P. 33

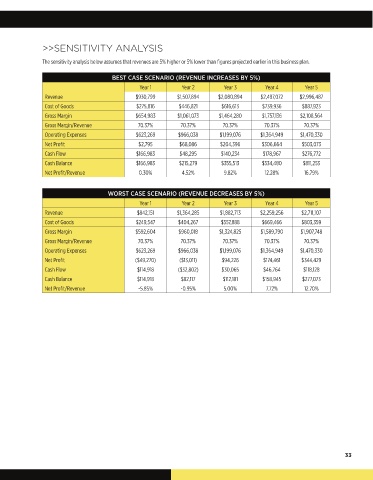

>>SENSITIVITY ANALYSIS

The sensitivity analysis below assumes that revenues are 5% higher or 5% lower than figures projected earlier in this business plan.

BEST CASE SCENARIO (REVENUE INCREASES BY 5%)

Year 1 Year 2 Year 3 Year 4 Year 5

Revenue $930,799 $1,507,894 $2,080,894 $2,497,072 $2,996,487

Cost of Goods $275,816 $446,821 $616,613 $739,936 $887,923

Gross Margin $654,983 $1,061,073 $1,464,280 $1,757,136 $2,108,564

Gross Margin/Revenue 70.37% 70.37% 70.37% 70.37% 70.37%

Operating Expenses $623,269 $966,038 $1,199,076 $1,364,949 $1,470,330

Net Profit $2,795 $68,086 $204,396 $306,664 $503,073

Cash Flow $166,983 $48,295 $140,234 $178,967 $276,772

Cash Balance $166,983 $215,279 $355,513 $534,480 $811,253

Net Profit/Revenue 0.30% 4.52% 9.82% 12.28% 16.79%

WORST CASE SCENARIO (REVENUE DECREASES BY 5%)

Year 1 Year 2 Year 3 Year 4 Year 5

Revenue $842,151 $1,364,285 $1,882,713 $2,259,256 $2,711,107

Cost of Goods $249,547 $404,267 $557,888 $669,466 $803,359

Gross Margin $592,604 $960,018 $1,324,825 $1,589,790 $1,907,748

Gross Margin/Revenue 70.37% 70.37% 70.37% 70.37% 70.37%

Operating Expenses $623,269 $966,038 $1,199,076 $1,364,949 $1,470,330

Net Profit ($49,270) ($13,011) $94,226 $174,461 $344,429

Cash Flow $114,918 ($32,802) $30,065 $46,764 $118,128

Cash Balance $114,918 $82,117 $112,181 $158,945 $277,073

Net Profit/Revenue -5.85% -0.95% 5.00% 7.72% 12.70%

33