Page 29 - AYZ.indd

P. 29

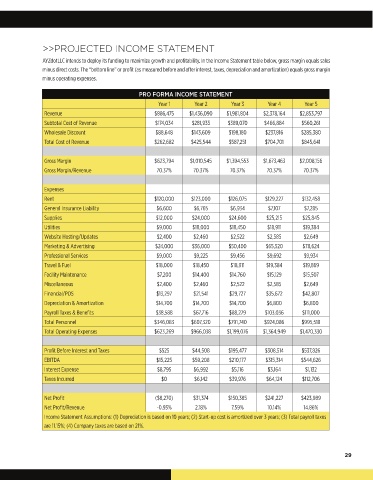

>>PROJECTED INCOME STATEMENT

AYZdotLLC intends to deploy its funding to maximize growth and profitability. In the Income Statement table below, gross margin equals sales

minus direct costs. The “bottom line” or profit (as measured before and after interest, taxes, depreciation and amortization) equals gross margin

minus operating expenses.

PRO FORMA INCOME STATEMENT

Year 1 Year 2 Year 3 Year 4 Year 5

Revenue $886,475 $1,436,090 $1,981,804 $2,378,164 $2,853,797

Subtotal Cost of Revenue $174,034 $281,935 $389,070 $466,884 $560,261

Wholesale Discount $88,648 $143,609 $198,180 $237,816 $285,380

Total Cost of Revenue $262,682 $425,544 $587,251 $704,701 $845,641

Gross Margin $623,794 $1,010,545 $1,394,553 $1,673,463 $2,008,156

Gross Margin/Revenue 70.37% 70.37% 70.37% 70.37% 70.37%

Expenses

Rent $120,000 $123,000 $126,075 $129,227 $132,458

General Insurance Liability $6,600 $6,765 $6,934 $7,107 $7,285

Supplies $12,000 $24,000 $24,600 $25,215 $25,845

Utilities $9,000 $18,000 $18,450 $18,911 $19,384

Website Hosting/Updates $2,400 $2,460 $2,522 $2,585 $2,649

Marketing & Advertising $24,000 $36,000 $50,400 $65,520 $78,624

Professional Services $9,000 $9,225 $9,456 $9,692 $9,934

Travel & Fuel $18,000 $18,450 $18,911 $19,384 $19,869

Facility Maintenance $7,200 $14,400 $14,760 $15,129 $15,507

Miscellaneous $2,400 $2,460 $2,522 $2,585 $2,649

Financial/POS $13,297 $21,541 $29,727 $35,672 $42,807

Depreciation & Amortization $14,700 $14,700 $14,700 $6,800 $6,800

Payroll Taxes & Benefits $38,588 $67,716 $88,279 $103,036 $111,000

Total Personnel $346,083 $607,320 $791,740 $924,086 $995,518

Total Operating Expenses $623,269 $966,038 $1,199,076 $1,364,949 $1,470,330

Profit Before Interest and Taxes $525 $44,508 $195,477 $308,514 $537,826

EBITDA $15,225 $59,208 $210,177 $315,314 $544,626

Interest Expense $8,795 $6,992 $5,116 $3,164 $1,132

Taxes Incurred $0 $6,142 $39,976 $64,124 $112,706

Net Profit ($8,270) $31,374 $150,385 $241,227 $423,989

Net Profit/Revenue -0.93% 2.18% 7.59% 10.14% 14.86%

Income Statement Assumptions: (1) Depreciation is based on 10 years; (2) Start-up cost is amortized over 3 years; (3) Total payroll taxes

are 11.15%; (4) Company taxes are based on 21%.

29