Page 31 - AYZ.indd

P. 31

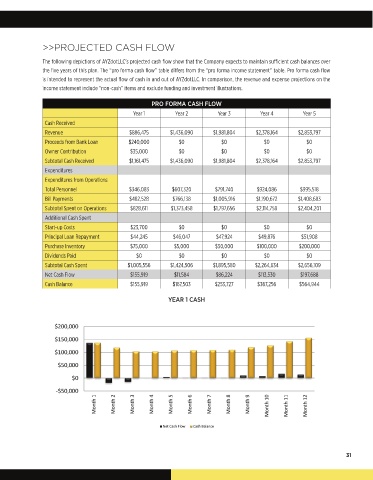

>>PROJECTED CASH FLOW

The following depictions of AYZdotLLC’s projected cash flow show that the Company expects to maintain sufficient cash balances over

the five years of this plan. The “pro forma cash flow” table differs from the “pro forma income statement” table. Pro forma cash flow

is intended to represent the actual flow of cash in and out of AYZdotLLC. In comparison, the revenue and expense projections on the

income statement include “non-cash” items and exclude funding and investment illustrations.

PRO FORMA CASH FLOW

Year 1 Year 2 Year 3 Year 4 Year 5

Cash Received

Revenue $886,475 $1,436,090 $1,981,804 $2,378,164 $2,853,797

Proceeds from Bank Loan $240,000 $0 $0 $0 $0

Owner Contribution $35,000 $0 $0 $0 $0

Subtotal Cash Received $1,161,475 $1,436,090 $1,981,804 $2,378,164 $2,853,797

Expenditures

Expenditures from Operations

Total Personnel $346,083 $607,320 $791,740 $924,086 $995,518

Bill Payments $482,528 $766,138 $1,005,916 $1,190,672 $1,408,683

Subtotal Spent on Operations $828,611 $1,373,458 $1,797,656 $2,114,758 $2,404,201

Additional Cash Spent

Start-up Costs $23,700 $0 $0 $0 $0

Principal Loan Repayment $44,245 $46,047 $47,924 $49,876 $51,908

Purchase Inventory $75,000 $5,000 $50,000 $100,000 $200,000

Dividends Paid $0 $0 $0 $0 $0

Subtotal Cash Spent $1,005,556 $1,424,506 $1,895,580 $2,264,634 $2,656,109

Net Cash Flow $155,919 $11,584 $86,224 $113,530 $197,688

Cash Balance $155,919 $167,503 $253,727 $367,256 $564,944

YEAR 1 CASH

31