Page 35 - Insurance Times July 2022

P. 35

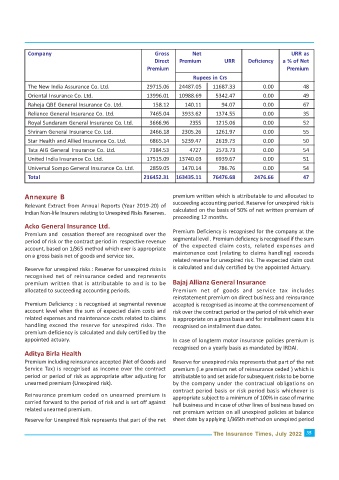

Company Gross Net URR as

Direct Premium URR Deficiency a % of Net

Premium Premium

Rupees in Crs

The New India Assurance Co. Ltd. 29715.06 24487.05 11687.33 0.00 48

Oriental Insurance Co. Ltd. 13996.01 10988.69 5342.47 0.00 49

Raheja QBE General Insurance Co. Ltd. 158.12 140.11 94.07 0.00 67

Reliance General Insurance Co. Ltd. 7465.04 3933.62 1374.55 0.00 35

Royal Sundaram General Insurance Co. Ltd. 3666.96 2355 1215.06 0.00 52

Shriram General Insurance Co. Ltd. 2466.18 2305.26 1261.97 0.00 55

Star Health and Allied Insurance Co. Ltd. 6865.14 5239.47 2619.73 0.00 50

Tata AIG General Insurance Co. Ltd. 7384.53 4727 2573.73 0.00 54

United India Insurance Co. Ltd. 17515.09 13740.03 6939.67 0.00 51

Universal Sompo General Insurance Co. Ltd. 2859.05 1470.14 786.76 0.00 54

Total 216452.31 163435.11 76476.68 2476.66 47

Annexure B premium written which is attributable to and allocated to

succeeding accounting period. Reserve for unexpired risk is

Relevant Extract from Annual Reports (Year 2019-20) of

calculated on the basis of 50% of net written premium of

Indian Non-life Insurers relating to Unexpired Risks Reserves.

preceeding 12 months.

Acko General Insurance Ltd.

Premium Deficiency is recognised for the company at the

Premium and cessation thereof are recognised over the

segmental level . Premium deficiency is recognised if the sum

period of risk or the contract period in respective revenue

of the expected claim costs, related expenses and

account, based on 1/365 method which ever is appropriate

maintenance cost (relating to claims handling) exceeds

on a gross basis net of goods and service tax.

related reserve for unexpired risk. The expected claim cost

is calculated and duly certified by the appointed Actuary.

Reserve for unexpired risks : Reserve for unexpired risks is

recognised net of reinsurance ceded and represents

premium written that is attributable to and is to be Bajaj Allianz General Insurance

allocated to succeeding accounting periods. Premium net of goods and service tax includes

reinstatement premium on direct business and reinsurance

Premium Deficiency : is recognised at segmental revenue accepted is recognised as income at the commencement of

account level when the sum of expected claim costs and risk over the contract period or the period of risk which ever

related expenses and maintenance costs related to claims is appropriate on a gross basis and for installment cases it is

handling exceed the reserve for unexpired risks. The recognised on installment due dates.

premium deficiency is calculated and duly certified by the

appointed actuary. In case of longterm motor insurance policies premium is

recognised on a yearly basis as mandated by IRDAI.

Aditya Birla Health

Premium including reinsurance accepted (Net of Goods and Reserve for unexpired risks represents that part of the net

Service Tax) is recognised as income over the contract premium (i.e premium net of reinsurance ceded ) which is

period or period of risk as appropriate after adjusting for attributable to and set aside for subsequent risks to be borne

unearned premium (Unexpired risk). by the company under the contractual obligations on

contract period basis or risk period basis whichever is

Reinsurance premium ceded on unearned premium is

appropriate subject to a minimum of 100% in case of marine

carried forward to the period of risk and is set off against

hull business and in case of other lines of business based on

related unearned premium.

net premium written on all unexpired policies at balance

Reserve for Unexpired Risk represents that part of the net sheet date by applying 1/365th method on unexpired period

The Insurance Times, July 2022 35