Page 49 - BANKING FINANCE FEBRUARY 2016 ONLINE

P. 49

RBI CIRCULAR

of interest equalisation provided by Government of For update news on Banking & Finance Industry

India.

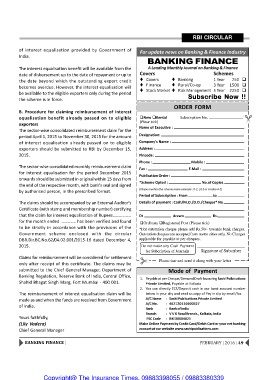

BANKING FINANCE

The interest equalisation benefit will be available from the

date of disbursement up to the date of repayment or up to A Leading Monthly Journal on Banking & Finance

the date beyond which the outstanding export credit

becomes overdue. However, the interest equalisation will Covers Schemes

be available to the eligible exporters only during the period

the scheme is in force. Covers Banking 1 Year 750

Finance

B. Procedure for claiming reimbursement of interest Stock Market Rural/Co-op 3 Year 1500

equalisation benefit already passed on to eligible

exporters Risk Management 5 Year 2250

The sector-wise consolidated reimbursement claim for the

period April 1, 2015 to November 30, 2015 for the amount Subscribe Now !!

of interest equalisation already passed on to eligible

exporters should be submitted to RBI by December 15, ORDER FORM

2015.

New Rental Subscription No.

The sector-wise consolidated monthly reimbursement claim (Plese tick)

for interest equalisation for the period December 2015

onwards should be submitted in original within 15 days from Name of Executive :

the end of the respective month, with bank's seal and signed

by authorised person, in the prescribed format. Designation: Mobile :

Company's Name : E.Mail :

The claims should be accompanied by an External Auditor's Address :

Certificate (with stamp and membership number) certifying Pincode : No.of Copies

that the claim for interest equalisation of Rupees…………….. Phone :

for the month ended ………….. has been verified and found Fax :

to be strictly in accordance with the provisions of the Publication Order :

Government scheme enclosed with the circular *Scheme Opted :

DBR.Dir.BC.No.62/04.02.001/2015-16 dated December 4,

2015. (Please mention the scheme name example : It-1, Lit-1 or Combo 4-1)

Claims for reimbursement will be considered for settlement Period of Subscription : From to

only after receipt of this certificate. The claims may be

submitted to the Chief General Manager, Department of Details of payment : Cash/M.O./D.D./Cheque* No

Banking Regulation, Reserve Bank of India, Central Office,

Shahid Bhagat Singh Marg, Fort Mumbai - 400 001. Dt drawn Rs.

The reimbursement of interest equalisation claim will be Ordinary Registered Post (Please tick)

made as and when the funds are received from Government

of India. *For outstation cheque please add Rs.50/- towards bank charges.

Outstation cheques are accepted from metro cities only. No Charges

Yours faithfully, applicable for payable at per cheques.

(Lily Vadera)

Chief General Manager Do not make any Cash Payment

for Subcription of Journals Signature of Subcriber

Please tear and send it along with your letter

Mode of Payment

1. Payable at per Cheque/Demand Draft favouring Sashi Pulbications

Private Limited, Payable at Kolkata

2. You can directly ECS/Deposit cash in our bank account number

below in your city and send us copy of Pay in slip by email/fax.

A/C Name : Sashi Publications Private Limited

A/C No. : 402120110000327

Bank : Bank of India

Branch : V V K Road Branch., Kolkata, India

IFSC Code : BKID0004021

Make Online Payment by Credit Card/Debit Card or your net banking

account at our website www.sashipublications.com

BANKING FINANCE | FEBRUARY | 2016 | 49

Copyright@ The Insurance Times. 09883398055 / 09883380339