Page 25 - Banking Finance April 2020

P. 25

PRESS RELEASE

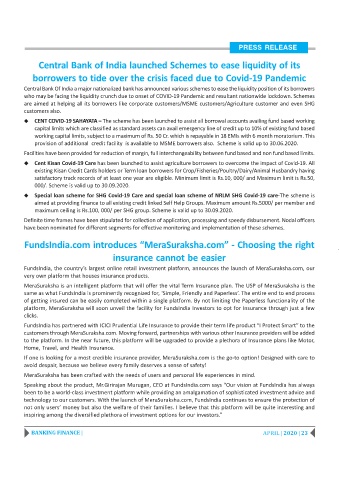

Central Bank of India launched Schemes to ease liquidity of its

borrowers to tide over the crisis faced due to Covid-19 Pandemic

Central Bank Of India a major nationalized bank has announced various schemes to ease the liquidity position of its borrowers

who may be facing the liquidity crunch due to onset of COVID-19 Pandemic and resultant nationwide lockdown. Schemes

are aimed at helping all its borrowers like corporate customers/MSME customers/Agriculture customer and even SHG

customers also.

X CENT COVID-19 SAHAYATA – The scheme has been launched to assist all borrowal accounts availing fund based working

capital limits which are classified as standard assets can avail emergency line of credit up to 10% of existing fund based

working capital limits, subject to a maximum of Rs. 50 Cr. which is repayable in 18 EMIs with 6 month moratorium. This

provision of additional credit facility is available to MSME borrowers also. Scheme is valid up to 30.06.2020.

Facilities have been provided for reduction of margin, full interchangeability between fund based and non fund based limits.

X Cent Kisan Covid-19 Care has been launched to assist agriculture borrowers to overcome the impact of Covid-19. All

existing Kisan Credit Cards holders or Term loan borrowers for Crop/Fisheries/Poultry/Dairy/Animal Husbandry having

satisfactory track records of at least one year are eligible. Minimum limit is Rs.10, 000/ and Maximum limit is Rs.50,

000/. Scheme is valid up to 30.09.2020.

X Special loan scheme for SHG Covid-19 Care and special loan scheme of NRLM SHG Covid-19 care-The scheme is

aimed at providing finance to all existing credit linked Self Help Groups. Maximum amount Rs.5000/ per member and

maximum ceiling is Rs.100, 000/ per SHG group. Scheme is valid up to 30.09.2020.

Definite time frames have been stipulated for collection of application, processing and speedy disbursement. Nodal officers

have been nominated for different segments for effective monitoring and implementation of these schemes.

FundsIndia.com introduces “MeraSuraksha.com” - Choosing the right

insurance cannot be easier

FundsIndia, the country’s largest online retail investment platform, announces the launch of MeraSuraksha.com, our

very own platform that houses insurance products.

MeraSuraksha is an intelligent platform that will offer the vital Term Insurance plan. The USP of MeraSuraksha is the

same as what FundsIndia is prominently recognized for, ‘Simple, Friendly and Paperless’. The entire end to end process

of getting insured can be easily completed within a single platform. By not limiting the Paperless functionality of the

platform, MeraSuraksha will soon unveil the facility for FundsIndia Investors to opt for Insurance through just a few

clicks.

FundsIndia has partnered with ICICI Prudential Life Insurance to provide their term life product “I Protect Smart” to the

customers through MeraSuraksha.com. Moving forward, partnerships with various other Insurance providers will be added

to the platform. In the near future, this platform will be upgraded to provide a plethora of Insurance plans like Motor,

Home, Travel, and Health Insurance.

If one is looking for a most credible insurance provider, MeraSuraksha.com is the go-to option! Designed with care to

avoid despair, because we believe every family deserves a sense of safety!

MeraSuraksha has been crafted with the needs of users and personal life experiences in mind.

Speaking about the product, Mr.Girirajan Murugan, CEO at FundsIndia.com says “Our vision at FundsIndia has always

been to be a world-class investment platform while providing an amalgamation of sophisticated investment advice and

technology to our customers. With the launch of MeraSuraksha.com, FundsIndia continues to ensure the protection of

not only users’ money but also the welfare of their families. I believe that this platform will be quite interesting and

inspiring among the diversified plethora of investment options for our investors.”

BANKING FINANCE | APRIL | 2020 | 23