Page 733 - Insurance Statistics 2021

P. 733

Indian Non-life Insurance Industry

Yearbook 2018-19

Chart 3.8.3 Underwriting Results (2010-2019)

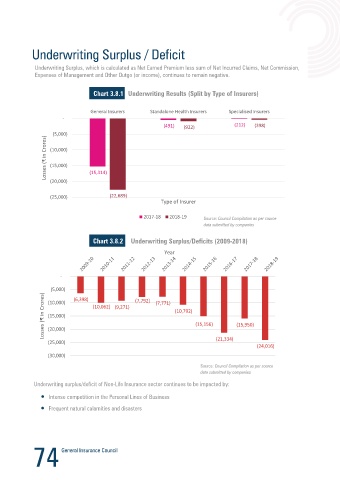

Underwriting Surplus, which is calculated as Net Earned Premium less sum of Net Incurred Claims, Net Commission,

Expenses of Management and Other Outgo (or income), continues to remain negative.

1,25,000

1,05,000

Chart 3.8.1 Underwriting Results (Split by Type of Insurers)

85,000

65,000

General Insurers Standalone Health Insurers Specialised Insurers 45,000

- 25,000

(491) (922) (212) (398) 5,000

(15,000)

(5,000) (35,000)

Losses (₹ in Crores) (10,000)

(15,000)

(20,000) (15,314)

Pure underwriting losses EOM + Net Commission Net Commission

(25,000) (22,689) Expenses of Mangement NIC+EOM+Net Commission

Type of Insurer

2017-18 2018-19 Source: Council Compilation as per source Source: Council Compilation as per source

data submitted by companies data submitted by companies

Chart 3.8.2 Underwriting Surplus/Deficits (2009-2018) Chart 3.8.4

Year Year

-

0%

(5,000)

(10,000) (6,398) (7,792) -5%

Losses (₹ in Crores) (15,000) (10,062) (9,271) (7,771) (10,792) (15,156) (15,950) -10% -15.2% -12.9% -16.0% -15.9%

U/W Losses (%)

-15%

(20,000)

(25,000) (21,334) -20% -22.6% -21.7% -20.0% -24.0% -21.2%

(24,016)

(30,000) -25%

-29.1%

Source: Council Compilation as per source

-30%

data submitted by companies

Underwriting surplus/deficit of Non-Life Insurance sector continues to be impacted by: Source: Council Compilation as per source

data submitted by companies

Intense competition in the Personal Lines of Business

Frequent natural calamities and disasters

74 75