Page 741 - Insurance Statistics 2021

P. 741

Indian Non-life Insurance Industry

Yearbook 2018-19

Chart 3.14.2 Shareholders Equity (Split by Type of Company)

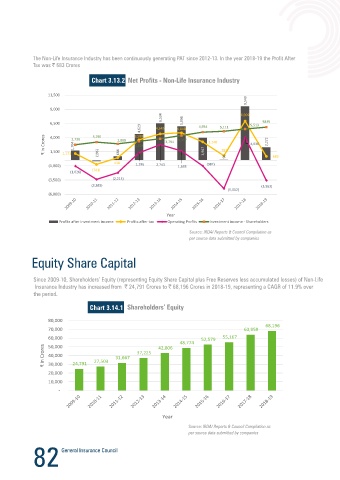

The Non-Life Insurance Industry has been continuously generating PAT since 2012-13. In the year 2018-19 the Profit After

Tax was 683 Crores 80,000 68,196

63,959

70,000

Chart 3.13.2 54,521 55,167

60,000 52,422

11,500 50,000 44,662

9,549

9,000 ₹ in Crores 40,000

6,534 6,909 30,000

6,500 5,994 5,513 5835

4,623 4,645 4,848 4,954 5,111 20,000 3,918 4,237 5,244 6,586 7,300 8,431

3,598

₹ in Crores 4,000 1,704 2,730 2,898 3,328 3,791 4,357 3,967 3,240 792 4,036 2,272 10,000

3,190

-

684

(196)

1,500

1,171

General Insurers

Standalone Health

98

683

Insurers Specialised Insurers Total

438 1,296 (987)

(1,000) 2,743 1,638 Type of Insurer

(741)

(1,026) 2016-17 2017-18 2018-19

Source: IRDAI Reports & Council Compilation as

(3,500) (2,215)

(3,385) (3,563) per source data submitted by companies

(5,012)

(6,000)

Post free pricing in 2007, the RoCE declined due to competitive pricing for commercial business. Administered premium

Year

Profits after investment income Profits after tax Operating Profits Investment income - Shareholders rates for Motor TP liability insurance, poor investment scenario following the global economic crisis that began in mid-2008

and the regulatory prescription for clean cut reserving for Motor TP Liability (arising from the dismantling of the IMTPIP) I

Source: IRDAI Reports & Council Compilation as

per source data submitted by companies n 2011 were contributory factors for the steep drop in ROCE from 2007 to 2011.

Additional infusion of fresh equity capital by private sector insurers to ensure they maintain the prescribed solvency margin

norms had its effect on RoCE. Deteriorating claim ratios in health insurance business has necessitated additional capital

infusion in Standalone Health companies also, thereby impacting RoCE..

The recovery seen in RoCE since 2011 is attributable to growth in Health Insurance Portfolio and revision in Motor TP

Since 2009-10, Shareholders’ Equity (representing Equity Share Capital plus Free Reserves less accumulated losses) of Non-Life as well as robust income from investment funds of the insurer partly to both increase in Motor TP administered rates

Insurance Industry has increased from 24,791 Crores to 68,196 Crores in 2018-19, representing a CAGR of 11.9% over every year and increase in investment incomes.

the period.

Chart 3.15.1

Chart 3.14.1

7,500 12%

80,000 6,909

68,196 9.9%

70,000 63,959 9.7% 10.9% 10.8% 10%

60,000 52,579 55,167 5,500 4,645 4,848 8%

48,774

50,000 42,806 3,598 6.2% 6%

₹ in Crores 40,000 24,791 27,503 31,667 37,225 ₹ in Crores 3,500 4.7% 3,240 4% RoCE (%)

30,000

20,000 1,500 1,171 1.4% 792 683 2%

438

10,000 1.4% 1.0% 0%

(500)

-

(741) -2%

-2.7%

(2,500) -4%

Year

Year

Source: IRDAI Reports & Council Compilation as Profits after Tax RoCE (%)

per source data submitted by companies Source: IRDAI Reports & Council Compilation as

per source data submitted by companies

82 83